- Joined

- Dec 18, 2020

- Posts

- 522

- Virgin

- Platinum

- Oneworld

- Sapphire

- Star Alliance

- Gold

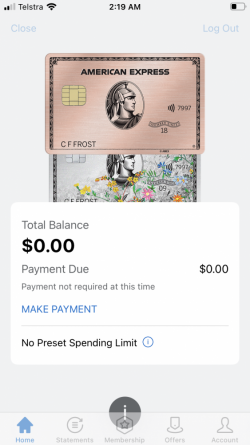

From what I know you can’t change your home address to a foreign one on Amex. They can send you a replacement card etc abroad but not make a permanent address change

Thanks guysMy understanding is that for address changes outside of the US, you would need to phone, and not through the on-line account.

The quote from tlam is somewhere upthread. Although it refers to a US Citi card, it may be something to keep in mind for Amex.

i actually have a UK Plat with my Australian address attached. Just had a quick look at that and it does say call if outside the UK

Assume the same applies in the US

Will give it 12mths and give them a call & see what happens