You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Strategy to obtain US Amex

- Thread starter ithongy

- Start date

- Featured

Was approved for my first Amex Business card, the Bonvoy one. Applied for the card with ITIN. The application wasn't approved on the spot and was asked to call their new accounts team for verification. The friendly agent verified the address, and approved the application. He did mention there was no hard pull on the credit enquiry and was solely approved based on the relationship with them.I’ll keep a closer eye out for next time Amex have this offer as it is good value pairing up the business with the personal card. I’ll need to figure out how to get an ITIN by then.

Does Amex have this bonus signup offer often throughout the year?

Last edited:

Got my ITIN from Sina B. from EIN Express. It took roughly 6 months for the process.I’ll keep a closer eye out for next time Amex have this offer as it is good value pairing up the business with the personal card. I’ll need to figure out how to get an ITIN by then.

Does Amex have this bonus signup offer often throughout the year?

Note: This isn't and advertisment but a review of his services.

jbmemories

Member

- Joined

- Jan 22, 2021

- Posts

- 215

- Qantas

- Platinum 1

- Oneworld

- Emerald

Similar to pyusha and a few others here, I got my ITIN from Sina B. actually yesterday. They even followed up with me today to make sure that I got the email and that everything was okay in terms of details of the application.

Took roughly 6 months from the start of application as well to get it sorted.

My recommendation is for those hoping to expand out from their first GT to get an application through (whether you do it yourself or take a service), and you should get an ITIN roughly the same time you get issued your FICO score.

Took roughly 6 months from the start of application as well to get it sorted.

My recommendation is for those hoping to expand out from their first GT to get an application through (whether you do it yourself or take a service), and you should get an ITIN roughly the same time you get issued your FICO score.

I also applied for a Cap1 360 checkings account and was approved after a phone call with them.

Their verification steps were quick and efficient and involved taking a picture of passport/driving license. Did it before applying for Amex business card, just in case they wanted to do a three way call with the bank.

Their verification steps were quick and efficient and involved taking a picture of passport/driving license. Did it before applying for Amex business card, just in case they wanted to do a three way call with the bank.

blacksultan

Established Member

- Joined

- May 1, 2017

- Posts

- 2,596

Did you need to have a business income ?Was approved for my first Amex Business card, the Bonvoy one. Applied for the card with ITIN. The application wasn't approved on the spot and was asked to call their new accounts team for verification. The friendly agent verified the address, and approved the application. He did mention there was no hard pull on the credit enquiry and was solely approved based on the relationship with them.

Post automatically merged:

Does anyone know if one can obtain an itin at no cost through holding a share trading account as someone mentioned here ?Similar to pyusha and a few others here, I got my ITIN from Sina B. actually yesterday. They even followed up with me today to make sure that I got the email and that everything was okay in terms of details of the application.

Took roughly 6 months from the start of application as well to get it sorted.

My recommendation is for those hoping to expand out from their first GT to get an application through (whether you do it yourself or take a service), and you should get an ITIN roughly the same time you get issued your FICO score.

blacksultan

Established Member

- Joined

- May 1, 2017

- Posts

- 2,596

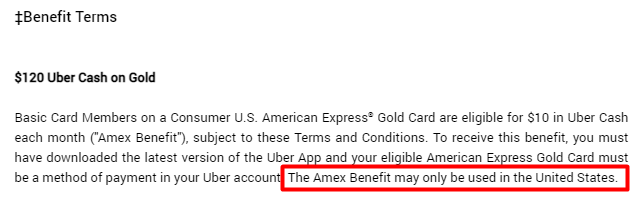

Can one use the uber eats credit available through the gold card in Australia ?

Ithongy has a good grasp on this sort of stuffDoes anyone know if one can obtain an itin at no cost through holding a share trading account as someone mentioned here ?

Technically yes. Followed thisDid you need to have a business income ?

Post automatically merged:

How To Apply For Amex Business Cards (2022)

Are you new to applying for American Express business cards? Here are some of the best options, and how to make sure you get approved.

blacksultan

Established Member

- Joined

- May 1, 2017

- Posts

- 2,596

Thank youTechnically yes. Followed this

How To Apply For Amex Business Cards (2022)

Are you new to applying for American Express business cards? Here are some of the best options, and how to make sure you get approved.onemileatatime.com

snabbu

Established Member

- Joined

- Sep 1, 2014

- Posts

- 1,736

- Qantas

- Platinum

- Oneworld

- Emerald

Do they actually cancel the additional card if you don't provide SSN within 60 days, as they threaten to do in the application?2500 bonus points available currently when you add an additional card holder and they spend $250 on the card . Up to 4 times .

blacksultan

Established Member

- Joined

- May 1, 2017

- Posts

- 2,596

Possibly . But if you don’t have ssn you can provide passport as I did .Do they actually cancel the additional card if you don't provide SSN within 60 days, as they threaten to do in the application?

nightelves

Active Member

- Joined

- Jan 11, 2016

- Posts

- 979

does anyone know if the Amex Qantas Premium can be transferred across?

There’s no transferring of cards, as such. You can keep your current Amex Oz cards, or close them if you wish.does anyone know if the Amex Qantas Premium can be transferred across?

Your relationship/history with Amex in Oz is what counts, when applying for a US Amex card using GT.

Edited

Last edited:

blacksultan

Established Member

- Joined

- May 1, 2017

- Posts

- 2,596

My friend in the us just received my new gold Amex . Can’t add it to my Apple wallet even though I could add my green card previously . Any ideas ?

Number of cards added to Apple Pay. Seems there's a limit of 4 or 5 cards. Try removing another one and then try adding the Gold.My friend in the us just received my new gold Amex . Can’t add it to my Apple wallet even though I could add my green card previously . Any ideas ?

blacksultan

Established Member

- Joined

- May 1, 2017

- Posts

- 2,596

Number of cards added to Apple Pay. Seems there's a limit of 4 or 5 cards. Try removing another one and then try adding the Gold.

[/i QUOTE]

Deleted some cards I wasn’t using . Still didn’t work . Can usually have 10 . Is this a Amex us requirement ? Have been in touch with the Apple Pay team Abe they will investigate and revert in 10 days or so .

Might be with not having the us Amex app .

blacksultan

Established Member

- Joined

- May 1, 2017

- Posts

- 2,596

Added card to Apple Pay . Was informed by a

Ex consultant that charge cards like gold. Green and platinum do not help in creating your credit report as opposed to a credit card like the preferred card . Is that true ?

Ex consultant that charge cards like gold. Green and platinum do not help in creating your credit report as opposed to a credit card like the preferred card . Is that true ?

US-issued Charge Cards do not factor into your credit utilisation rate. However, they factor into payment history, average age of accounts and the number of new inquiries.Added card to Apple Pay . Was informed by a

Ex consultant that charge cards like gold. Green and platinum do not help in creating your credit report as opposed to a credit card like the preferred card . Is that true ?

If I was starting out on establishing a credit history, I would obtain a credit card, or two, before going after a charge card.

Edit: How Do Charge Cards Affect Your Credit Score?

Do Charge Cards Affect My Credit Score the Same as Credit Cards? - NerdWallet

Last edited:

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- metaphase

- #flying

- crosscheck

- Rayesfeg

- markis10

- wentworthmeister

- kpro

- Thibault

- MEL_Traveller

- Dr4manyspecies

- funnybrus

- Stephanie Logan

- kelvedon

- Balus1

- PineappleSkip

- JohnM

- nonrev-jez

- jase05

- Grrr

- cpatters

- pks

- Strikes

- Chris Panda

- georgie23

- Stevo.1702

- MB123

- Austman

- BrockF

- http_x92

- Scarlett

- redbigot

- BodohBordeaux

- mitti

- Harrison_133

- Flechette1866

- Himeno

- Cottman

- JessicaTam

- Denali

- ayebee

- Steady

- Pete98765432

- swellington

- VantageXL

- ghinx

- Wanderlust_tim

- mrak

- MooTime

- ausfox

- kuwahshi

Total: 1,026 (members: 68, guests: 958)