Nice work and good thinking on using "Apt" rather than "Ste". I don't want to temp the red flag gods just yet by updating my address. Got to find a way to change it to my Aussie mailing address next.However, what I did differently was to include “Apt xx_x-xx_“ in both the first and second address boxes (as well as the street address in the first address box) on the Amex application, rather than use “Ste”

Seems like you had a really smooth experience.

If you are really desperate you can always use your online bank e.g. Citibank online to make the wire transfer. The rates and fees won't be nearly as good as FX platforms, but at least your card will be in good standing.Now, the problem that I have is to work out how to pay the card statement balance, when due. My original plan was to pay through TorFX, but when they phoned to ask (after I set up a ‘tester’ payment in order to verify the banking details) if this was a payment to a credit card, that was the end of that. Now to look into the other options, although it will need to be by International Wire transfer, regardless.

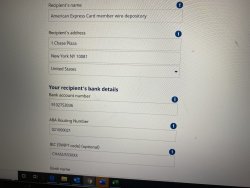

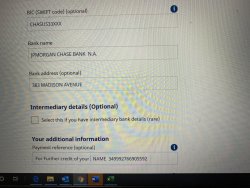

Amex Chat has provided me wih the following details:

- Bank Name

- Bank Address

- Routing Number

- For further credit to (my name) and (Amex account #)

- SWIFT

- Account Number

That part is all good.

However, I now want to set up the Recipient details in the XE account, so as I can pay into the Aspire card account. XE asks for the following:

- Recipient Name

- Recipient Address

Am I missing something here? Is the Recipient meant to be my name/address (or the "American Express Wire Depository"), or something else? This is something that many would have already done. Perhaps someone who has already done this can point me in the right direction (as to what I'm meant to enter), regarding the Recipient information, please. It's probably quite obvious but I'm not seeing it.

Thanks.

Edit: For content

Is there an option to select a company? For the looks of it the XE platform you are using wants to send to an Individual rather than Company. It probably doesn't even matter that much, I would have just used the "American Express Wire Depository" in the "recipient name" field and bank address in the "recipient address" field. When you enter the Routing number or Swift code that should automatically give them the "bank name" and branch. And FFC instructions should be in the "Recipient Reference" field or similar. That I would say is the most important bit of info or else your funds are just going to be stuck in limbo.

Yes makes sense that there would be more depositories for AMEX. Having 1 would just be a logistical nightmare lol.Edit: Some may find this information to be useful. However, my guess is that there are probably numerous addresses that could be used for Amex, and probably numerous Recipient Names, as well.

I should add that it was like pulling teeth to get Chat to provide the Recipient details for some reason. Took three phone calls in the end.