PointsLife1

Member

- Joined

- Jan 30, 2020

- Posts

- 196

View attachment 238064

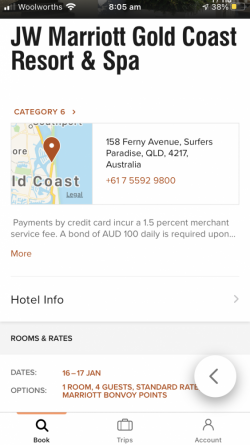

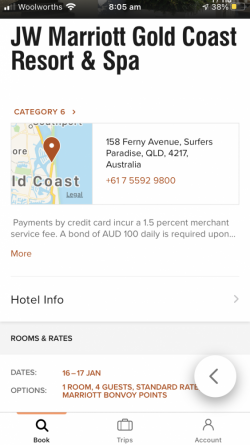

JW Marriott Gold Coast is still category 5.

Post automatically merged:

Strange my screen advises category 6.

View attachment 238064

JW Marriott Gold Coast is still category 5.

Strange my screen advises category 6.

Is this your first card? how long have you had this card?I just got an email from Amex US asking me to update my income for my Hilton Aspire card, are they reviewing my account? I hope it is not the start of a financial review.

I received my Aspire (my only Amex) in mid January 2020, with the $5,000 credit limit. Same time as glasszon, from memory. So I hope that there’s not much to worry about.Is this your first card? how long have you had this card?

Whats the total credit limit you have reached with Amex? Read DP in forums and blogs, 35k limit is the time more qts are asked.

Is this your first card? how long have you had this card?

Whats the total credit limit you have reached with Amex? Read DP in forums and blogs, 35k limit is the time more qts are asked.

It looks like United Travel Bank is dead starting Jan 14. Got my 2 Airline credits early this year, hope no clawback.

You are right. just checked they actually quietly increased the cat from 5 to 6.

just got approached by club marriott. the annual fee is 399 and they give two club marriott cards, one main and one supplementary card. Anyone is interested in joining together and share the cost?

It is similar fee in Asian countries but offer more dinning vouchers, hotel room voucher for the hotel you joined the program. As we are in Australia it makes more sense to join the program as pacific member here as we are not based in Asian countries. Marriott brilliant credit card has nothing to do with this program. You can have both and the benefits do not overlap.I got an email from club marriott too, it looks like the annual fee is country specific, can we obtain club marriott via another country to get a lower annual fee? For example, accor plus tend to be cheaper in Southeast Asia countries.

(And given this is posted in the Amex US thread, is Club Marriott better or signing up for the Marriott Brilliant credit card be better?)

|

| In addition to amex, this is handy when moving overseas to get a local card. |

Success!!! Approved for my first Chase credit card and wow that it some process as I woke up at 5:00am to call Chase after receiving "please call us to confirm application letter" I had to speak to 4 consultants over 44 minutes and most of the time you are in silence. Finally at the end we have some good news and you have been approved.Those are standard. Chase never says they accept a bank statement and at one point (even last year), they rejected it (HUCA did the trick). They seem cool with statements these days. 99% approval

Success!!! Approved for my first Chase credit card and wow that it some process as I woke up at 5:00am to call Chase after receiving "please call us to confirm application letter" I had to speak to 4 consultants over 44 minutes and most of the time you are in silence. Finally at the end we have some good news and you have been approved.