How did you manage half fees for the last few years?I will be cancelling my card in January, the renewal is in February. I just called up to use my free night in December and got my hotel of choice, so that's good. I also have been receiving half fees for the last few years, but even with that it's no longer worth holding.

The PP is losing value too as many restaurants in the airports are leaving (for example, the PF Changs at LAX has left) and their lounges are truly average. (well any that I have used, anyway.) We are normally in J on long haul though so use the J lounge.

I will keep it until the end of the year and the lovely concierge also said that he would email through a list of the benefits that I haven't yet used for the year.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Several Prestige Credit Card Benefits to be Eliminated Jan 2020 (And I'm Not Happy!)

- Thread starter Emporium

- Start date

- Status

- Not open for further replies.

Called Citibank expressing my disappointment - didn’t say I would cancel- just said it’s not fair to pay aud 700 , then after reduce what the 700 gets you. I asked them to have a meeting about it. Took them a week to call me back and offer 30000 points . Which I accepted

What blows my mind is there absolutely is NOT going to be a reduction in the annual fee (I've asked Citibank - it will remain $700). Besides Priority Pass and Insurance - EVERY other benefit has been either downgraded or eliminated - and they still have the nerve to demand $700.

When I called Citbank (not the third party concierge - but Citibank directly) the gentleman I spoke to actually agreed with me that Prestige cardholders where getting massively screwed over. The way that he spoke about this matter, it came across as If Citibank are purposefully screwing us over as some kind of test to see if cardholders are actually going to complain and do something about the multiple benefit downgrades/eliminations.

....

From a review of Citi's published Prestige benefits as per their website, it sounds like Citi have done absolutely nothing in response to feedback, such as that quoted above.

At least cut the annual fee, and eliminate the whopping 3.4% surcharge for using the card overseas or at a merchant facility located overseas. Perhaps, then Australian frequent flyer members might actually use this card when travelling, instead of mothballing it for better alternatives suited for travel, such as the ANZ Travel Adventures Visa, or the Coles Mastercard!

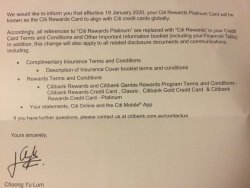

I have a further update about the Citi Prestige card.

Very soon email correspondence will be sent out to cardholders that Citi Prestige will no longer be a VISA INFINITE credit card (the world's most premium Visa card).

Citi Prestige is going to become a Mastercard instead. The issue is that the Mastercard equivalent to VISA INFINITE is the MASTERCARD WORLD ELITE - which is NOT available in Australia. Thus the Citi Prestige VISA INFINITE is turning into a bog-standard Mastercard.

This is also going to mean the hassle of Citi Prestige cardholders likely having their credit card number changed (I guess issued a new card) due to the switch to Mastercard.

Seriously I am so infuriated - I book a lot of my hotel stays via Visa Luxury Hotel Collection (it provides VISA INFINITE cardholders with automatic VIP status and best rate guarantee PLUS free room upgrade, free breakfast, free food/beverage credit, free late checkout, plus more VIP perks).

WTF are Citibank doing? Why are they actively trying to screw over their prestige credit card customers who are paying the most in annual fee and are also their biggest spenders?

Citi Prestige cards in other parts of the world have stacks of extra privileges and benefits (e.g. $350 travel credit every year for any travel related expense made on the card, a whopping EIGHT free airport transfers a year, unlimited wifi internet access across the world via millions of wifi hotspots)...and we here in Australia are getting shafted by Citibank.

Very soon email correspondence will be sent out to cardholders that Citi Prestige will no longer be a VISA INFINITE credit card (the world's most premium Visa card).

Citi Prestige is going to become a Mastercard instead. The issue is that the Mastercard equivalent to VISA INFINITE is the MASTERCARD WORLD ELITE - which is NOT available in Australia. Thus the Citi Prestige VISA INFINITE is turning into a bog-standard Mastercard.

This is also going to mean the hassle of Citi Prestige cardholders likely having their credit card number changed (I guess issued a new card) due to the switch to Mastercard.

Seriously I am so infuriated - I book a lot of my hotel stays via Visa Luxury Hotel Collection (it provides VISA INFINITE cardholders with automatic VIP status and best rate guarantee PLUS free room upgrade, free breakfast, free food/beverage credit, free late checkout, plus more VIP perks).

WTF are Citibank doing? Why are they actively trying to screw over their prestige credit card customers who are paying the most in annual fee and are also their biggest spenders?

Citi Prestige cards in other parts of the world have stacks of extra privileges and benefits (e.g. $350 travel credit every year for any travel related expense made on the card, a whopping EIGHT free airport transfers a year, unlimited wifi internet access across the world via millions of wifi hotspots)...and we here in Australia are getting shafted by Citibank.

Last edited:

I think the explanation re switch to MasterCard is they inked a deal with MC some time ago to replace their portfolio of Visa cards with MC. In Australia, they initially rolled out the change to debit cards (my debit was Visa and got changed to MC). The changes appear to be rolling out to other products now. I think a Prestige in the US Has long been a MC. Doesn’t cover off on the product devaluation though but should explain the shift to MC. Agree not sure why it’s not going to World Elite status.

Daver6

Enthusiast

- Joined

- Dec 31, 2011

- Posts

- 12,269

- Qantas

- Platinum

- Virgin

- Silver

WTF are Citibank doing? Why are they actively trying to screw over their prestige credit card customers who are paying the most in annual fee and are also their biggest spenders?

They probably feel they can get away with it given Amex recently screwed over their top card (well all really) holders with an increase in annual fees, a reduction in benefits and reduction in earn rate.

Called Citibank expressing my disappointment - didn’t say I would cancel- just said it’s not fair to pay aud 700 , then after reduce what the 700 gets you.

Would people have been happy if the kept all the benefits but increased the annual fee?

Overtime everything costs more, and prices increase (and generally our income increases).

The reality is they cant hold the benefits and the annual fee the same forever. Surely every 5 years or so, something has to change. Many lenders do this by retiring products and launching new ones.

That makes absolute sense. It's a shame we all hate telling our customers the price is going up because our cost of providing the benefits we've promised has gone up. Doesn't show any confidence in their product if they're making up stuff like "our customers told us to reduce the benefits". Surely, it's clear no one will believe that. All Citi needs to do is just say that as a justification for increasing the annual fee rather than kill any customer goodwill by reducing benefits to help fit within the same annual fee budget with no explanation.

1. Besides priority pass and travel insurance - EVERY other Citi Prestige benefit has now been eliminated or downgraded...

* Fourth Night Free Hotel Stay - use to be unlimited, now capped to only being able to use 4 times a year.

* Complimentary Airport Transfer - use to be two free transfers (and can be used globally), now only once a year (and only in Australia).

* Complimentary One Night Hotel Stay - GONE!

* Airport Meet & Assist - GONE!

* Complimentary Golf Course Access - GONE!

Let's not forget this is a $700 annual fee credit card with a ridiculously high interest rate, high foreign exchange rate/overseas use surcharge, and a lesser interest free period compared to other credit cards.

Nobody should be worried about Citibank's bottom line - i'm guessing they are making a LOT of money from Citi Prestige cardholders (who earn at least 150K a year - and thus are likely big spenders and big travellers).

2. The Citi Prestige card in Australia already had less benefits compared to other parts of the world where Citi Prestige is also available (e.g eight free airport transfer yearly, hundreds upon hundreds of dollars in travel credit yearly for travel related expenses).

3. Citibank are blatantly lying to cardholders by stating the reason why so many benefits have now been eliminated/downgraded is because cardholders have reached out to the Citi Prestige concierge department (a third party company) and expressed that they don't want such benefits. Does it sound believable to you that cardholders are calling up Prestige concierge and saying "pretty please, can you take away my yearly benefit to enjoy a complimentary night stay at a luxurious 5 star hotel"?

Also note, cardholders (as mentioned throughout this thread) have called Prestige concierge and concierge have flat out DENIED they expressed to Citibank to remove such benefits. In fact concierge have said the opposite, that benefits that Citbank alleged cardholders didn't want - were in fact popular and being used by cardholders.

* Fourth Night Free Hotel Stay - use to be unlimited, now capped to only being able to use 4 times a year.

* Complimentary Airport Transfer - use to be two free transfers (and can be used globally), now only once a year (and only in Australia).

* Complimentary One Night Hotel Stay - GONE!

* Airport Meet & Assist - GONE!

* Complimentary Golf Course Access - GONE!

Let's not forget this is a $700 annual fee credit card with a ridiculously high interest rate, high foreign exchange rate/overseas use surcharge, and a lesser interest free period compared to other credit cards.

Nobody should be worried about Citibank's bottom line - i'm guessing they are making a LOT of money from Citi Prestige cardholders (who earn at least 150K a year - and thus are likely big spenders and big travellers).

2. The Citi Prestige card in Australia already had less benefits compared to other parts of the world where Citi Prestige is also available (e.g eight free airport transfer yearly, hundreds upon hundreds of dollars in travel credit yearly for travel related expenses).

3. Citibank are blatantly lying to cardholders by stating the reason why so many benefits have now been eliminated/downgraded is because cardholders have reached out to the Citi Prestige concierge department (a third party company) and expressed that they don't want such benefits. Does it sound believable to you that cardholders are calling up Prestige concierge and saying "pretty please, can you take away my yearly benefit to enjoy a complimentary night stay at a luxurious 5 star hotel"?

Also note, cardholders (as mentioned throughout this thread) have called Prestige concierge and concierge have flat out DENIED they expressed to Citibank to remove such benefits. In fact concierge have said the opposite, that benefits that Citbank alleged cardholders didn't want - were in fact popular and being used by cardholders.

Last edited:

The cut in benefits, however, seems disproportionate to the rise in CPI and Citibank is severely slashing customer-benefit, making what was once a great card into a very poor one. Very similar to Amex on their high end Platinum Charge Card, with the relatively-recent points devaluation.

Last edited:

Duffa

Established Member

- Joined

- Aug 18, 2011

- Posts

- 1,738

I've been on 1/4 annual fee for the past 3 years - before you ask, I just rang up and was granted - but will no longer continue beyond my renewal in August.

I'll use the PP 8 times in the next 6 months so ~$20 a lounge visit isn't bad

I used to put through 500k a year in the 1.33333 days but all that has gone. I'm lucky if my monthly bill tops $1000 now.

It's sad I know, but Prestige was ridiculously generous in the good old days and they have only just woken up. Now it seems that the pendulum has swung the opposite way and they are the sh***est card in the market. But hey, they'll see the numbers and respond as they see fit.

As always, I'll be reading and watching, ready to take advantage of any changes.

I'll use the PP 8 times in the next 6 months so ~$20 a lounge visit isn't bad

I used to put through 500k a year in the 1.33333 days but all that has gone. I'm lucky if my monthly bill tops $1000 now.

It's sad I know, but Prestige was ridiculously generous in the good old days and they have only just woken up. Now it seems that the pendulum has swung the opposite way and they are the sh***est card in the market. But hey, they'll see the numbers and respond as they see fit.

As always, I'll be reading and watching, ready to take advantage of any changes.

Re complimentary airport transfers. In December my (1 out of 2) airport transfer was in the free area in Perth. In January my exact same location to airport transfer came with an additional $9usd charge. Not only has the number halved but the cost has gone up.

Jack_OC

Established Member

- Joined

- Oct 1, 2012

- Posts

- 1,651

- Qantas

- Platinum 1

- Virgin

- Silver

- SkyTeam

- Elite Plus

- Star Alliance

- Silver

I'm currently on the last few months of the 20,000 bonus points/month sign up offer from 2018. I assume that will be unaffected by the changes, so I guess i have an incentive to stick with it until then. Once that's up though, there is no question I'm cancelling.

The only meaningful benefit that remains is Priority Pass. I personally don't use that much, as I usually have "proper" lounge access anyway. I realise that's not the case for everyone, but even if people use this benefit a lot, it's important to remember that you can simply pay for PP lounge visits instead, and you would really have to do that a lot to rack up $700 worth of value (bearing in mind that you can get free PP membership and 2 free lounge visits per year with lots of very cheap - in some cases fee free - credit cards).

BTW, is it true that they are switching from Visa to MC? It is again possible to apply for the Prestige card online, and it's still a Visa card. Hard to understand why they would make it available again as a Visa (having not been available to new customers at all for a while), if they are about to change to MC? Mind you, the whole fiasco is pretty hard to understand.

The only meaningful benefit that remains is Priority Pass. I personally don't use that much, as I usually have "proper" lounge access anyway. I realise that's not the case for everyone, but even if people use this benefit a lot, it's important to remember that you can simply pay for PP lounge visits instead, and you would really have to do that a lot to rack up $700 worth of value (bearing in mind that you can get free PP membership and 2 free lounge visits per year with lots of very cheap - in some cases fee free - credit cards).

BTW, is it true that they are switching from Visa to MC? It is again possible to apply for the Prestige card online, and it's still a Visa card. Hard to understand why they would make it available again as a Visa (having not been available to new customers at all for a while), if they are about to change to MC? Mind you, the whole fiasco is pretty hard to understand.

They absolutely are switching from Visa Infinite (the world's most prestigious Visa card) to simply Mastercard.

You can call Citibank on 13 24 84 (or their priority phone number for Citi Prestige customers - 02 8225 0042) and ask them for yourself.

I'm not exactly sure when it's going to come into effect - but it's definitely sometime in the next few months.

Everyone that is upset with Citibank's recent changes - I urge you to call them and tell them how you feel. At this point, if you are still paying $700 in annual fee - that is insane. Call them and complain and see if you can negotiate a lower annual fee.

They are being bombarded with complaints (one Citibank call centre representative told me so).

Before when Citi Prestige cardholders contacted the call centre, they used to be unapologetic and simply state that the decision to remove/downgrade nearly every benefit was because cardholders were complaining about now wanting the benefits (an obvious lie).

Now when you call and complain, the call centre representatives are VERY apologetic and profusely go on about how the cardholder's feedback is important and that it will absolutely be sent to senior management.

I think Citibank underestimated just how many cardholders were going to cancel their Prestige cards.

It blows my mind how they thought they could scrap or downgrade every single benefit besides travel insurance/priority pass, continue to charge a $700 annual fee - and expect Citi Prestige cardholders to be OK with it.

What idiots! Of all their customers to screw over, they decided they will screw over their most elite clientele who are the biggest spenders, pay the most in annual fee, pay a ridiculously high interest rate, and pay a high foreign exchange rate/overseas use surcharge. Not to mention i'm sure a lot of Citi Prestige cardholders are also Citi Gold customers who have a lot of money tied up in savings/investment with Citibank.

You can call Citibank on 13 24 84 (or their priority phone number for Citi Prestige customers - 02 8225 0042) and ask them for yourself.

I'm not exactly sure when it's going to come into effect - but it's definitely sometime in the next few months.

Everyone that is upset with Citibank's recent changes - I urge you to call them and tell them how you feel. At this point, if you are still paying $700 in annual fee - that is insane. Call them and complain and see if you can negotiate a lower annual fee.

They are being bombarded with complaints (one Citibank call centre representative told me so).

Before when Citi Prestige cardholders contacted the call centre, they used to be unapologetic and simply state that the decision to remove/downgrade nearly every benefit was because cardholders were complaining about now wanting the benefits (an obvious lie).

Now when you call and complain, the call centre representatives are VERY apologetic and profusely go on about how the cardholder's feedback is important and that it will absolutely be sent to senior management.

I think Citibank underestimated just how many cardholders were going to cancel their Prestige cards.

It blows my mind how they thought they could scrap or downgrade every single benefit besides travel insurance/priority pass, continue to charge a $700 annual fee - and expect Citi Prestige cardholders to be OK with it.

What idiots! Of all their customers to screw over, they decided they will screw over their most elite clientele who are the biggest spenders, pay the most in annual fee, pay a ridiculously high interest rate, and pay a high foreign exchange rate/overseas use surcharge. Not to mention i'm sure a lot of Citi Prestige cardholders are also Citi Gold customers who have a lot of money tied up in savings/investment with Citibank.

Last edited:

Jack_OC

Established Member

- Joined

- Oct 1, 2012

- Posts

- 1,651

- Qantas

- Platinum 1

- Virgin

- Silver

- SkyTeam

- Elite Plus

- Star Alliance

- Silver

Would people have been happy if the kept all the benefits but increased the annual fee?

Overtime everything costs more, and prices increase (and generally our income increases).

The reality is they cant hold the benefits and the annual fee the same forever. Surely every 5 years or so, something has to change. Many lenders do this by retiring products and launching new ones.

Seriously, forget about comparing to what they offered in the past and compare what they are offering now to other cards with much lower fees. There is really no valid reason why anyone would keep this card now, except perhaps someone who uses the PP benefit incredibly often.

What idiots! Of all their customers to screw over, they decided they will screw over their most elite clientele who are the biggest spenders, pay the most in annual fee, pay a ridiculously high interest rate, and pay a high foreign exchange rate/overseas use surcharge. Not to mention i'm sure a lot of Citi Prestige cardholders are also Citi Gold customers who have a lot of money tied up in savings/investment with Citibank.

I fully agree that these changes are idiotic for such an expensive card. However, I think they made this card non-viable for most people when they slashed points earning rates a couple of years back (I cancelled my original Prestige card at the time for this reason, and only took out another one for the sign up bonus).

You are correct that anyone who holds this card has a high income and likely spends a lot, but I doubt if many are using this particular card for much of their spending. It only has a good points earning rate with restaurants, hotels, airlines and overseas, but in the vast majority of cases, you can use Amex for all of the above, and earn even more points. The Prestige card now earns an embarrassing 0.4 SQ/VA pts/$ by default, and that is what you'll get at a lot of merchants that don't accept Amex. I have mostly just ensured that I meet the minimum $2,000 per month to get the sign on bonus of 20,000 points per month (effectively 8,000 FF points), and I always planned to stop using it once that offer came to an end. I suspect a lot of other people have also diverted much of their spending away from this card in recent years, so it probably isn't profitable for Citibank anymore. They should just kill it altogether at this point IMHO - asking people to pay $700 a year for it now is a complete joke.

Must...Fly!

Senior Member

- Joined

- Jan 12, 2010

- Posts

- 8,233

- Qantas

- Gold

- Virgin

- Platinum

It's pretty obvious what they're doing, isn't it? No complaining is going to help. They have lost interest in supporting a high-value card such as this one, but they don't want to completely abandon the banking relationship with high earning/banking clientele. Solution, remove/reduce benefits to a level that you know some will cancel the card and reduce your costs to make it profitable. Hope that many do not analyse benefits too closely and will still be happy with what you offer now.

If you are not a huge point chaser or churner and stay in expensive hotels, it would still be easy to get more than $700 value out of the card from first glance, and that's what many people will look at and calculate. If you're not happy, cancel and move on. Look for a 100k sign up bonus somewhere else - if you hold this card I am sure most banks will welcome you with open arms!

- if you hold this card I am sure most banks will welcome you with open arms!

If you are not a huge point chaser or churner and stay in expensive hotels, it would still be easy to get more than $700 value out of the card from first glance, and that's what many people will look at and calculate. If you're not happy, cancel and move on. Look for a 100k sign up bonus somewhere else

D

Deleted member

Guest

sounds like a commercial / business decision, I guess you can vote with your feet

- Status

- Not open for further replies.

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

Total: 901 (members: 12, guests: 889)