- Joined

- Mar 1, 2019

- Posts

- 3,097

- Qantas

- Qantas Club

- Virgin

- Platinum

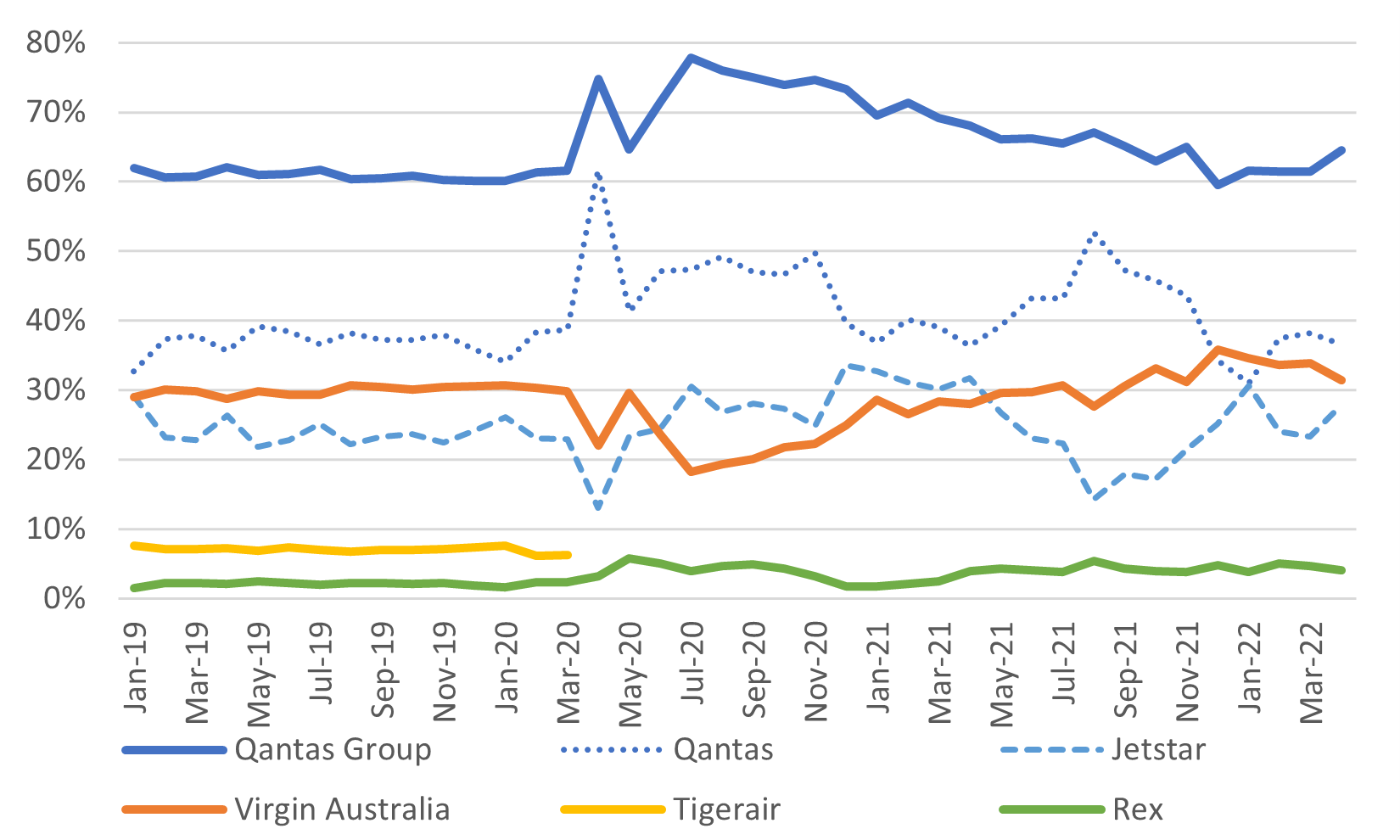

well i don't keep every article i read on hand, but its been well documented as your graph shows QF drifted south (~78% to ~64) & VA lifted a tad (~18% to 32%). more than blip, a little trend may we say. nice you mentioned the last smidgeon of a 2 year graph.Share of what though? Discounted domestic flights?

Fare differences alone between the two airlines will more than make up for a few percentages of domestic market share.

Edit - where's your source for this?

The last I have is this graph which was from April. Trajectory was down for VA, QF was up.

Just search anything airlines QF VA market share etc plenty there.

Anyhow my point was that if QF can keep increasing it's prices to cover for any lack of pax then that's fine. Listed company shareholders yes all aware.

anyhow I think the email from AJ was weak & just wanted to address the turn back & technical issue lately & throw in a boast about their reliability according to their own website.

Just another story of QF not doing a thing wrong basically.

They certainly are a match fit airline.