Well, all the documents are available online to review.

www1.citibank.com.au

View attachment 474524

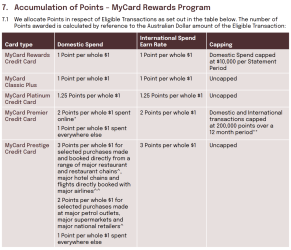

* For MyCard Premier Cardholders a transaction qualifies as an Eligible Transaction made online if it is made via the internet or a

mobile application, which is reflected as an online transaction by system indicators and processed by the respective merchants/

acquirers as an online transaction through Visa/Mastercard networks.

** For MyCard Premier Cardholders the annual cap will reset on your next Statement Cycle date following the anniversary of your

enrolment to your Rewards Program.

^ For MyCard Prestige Cardholders whether or not a purchase is eligible to earn Points will be determined based on card scheme

information ultimately provided either by the merchant (including individual outlets) or its financial institution (including

information about the type of business conducted by the merchant). If, for example, a restaurant is not classified as a

restaurant by the card scheme, it will not be treated as a “major restaurant” for calculating Points.

^^ For MyCard Prestige Cardholders purchases not ordered or booked directly from the restaurant,