You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Meet the points geeks

- Thread starter CaptJCool

- Start date

ChrisMars

Established Member

- Joined

- Sep 16, 2017

- Posts

- 1,433

- Qantas

- Platinum

- Virgin

- Red

The angle of the pictures, the framing, and bluriness make it a bit hard to process for my little brain. Thanks god chatgpt is less judgemental and more patient. Hopefully it got the gist correctly, that's what it outputted for me below.

The article explains how Australians can extract significant value from frequent-flyer points, particularly through credit cards and strategic everyday spending, but warns that it requires discipline and effort.

Frequent-flyer programs still offer strong value, especially for premium travel, but:

Summary of the Article

The article explains how Australians can extract significant value from frequent-flyer points, particularly through credit cards and strategic everyday spending, but warns that it requires discipline and effort.

Key Points

- Credit card sign-up bonuses are the main driver of points, not everyday spend.

- While earn rates per dollar have declined over the past decade, bonuses have increased.

- A single application can yield 100,000–130,000 points (Qantas or Virgin).

- Annual fees can still be good value

- Paying a ~$300–$400 annual fee can be worthwhile if it delivers enough points for:

- Business-class flights to Asia, or

- Substantial long-haul upgrades.

- Paying a ~$300–$400 annual fee can be worthwhile if it delivers enough points for:

- The biggest mistake is applying too often

- Applying for cards every few months makes you look credit-desperate.

- The recommended approach is intentional, spaced-out applications aligned to real financial needs.

- Banks are adapting

- Some now offer 20,000–40,000 bonus points in the second year, once the annual fee is paid, to reduce customer churn.

- Everyday spending still matters, but less so

- Supermarkets (e.g. Woolworths Everyday Rewards) and utilities can add points, but:

- It takes ~$10,000 spend to earn ~2,000 Qantas points, often poor value.

- The real value comes from converting points into premium flights, not gift cards.

- Supermarkets (e.g. Woolworths Everyday Rewards) and utilities can add points, but:

- Mortgage and loan switching can be lucrative

- Some borrowers switch multiple loans to Qantas-branded products and earn hundreds of thousands of points.

- One example cited collected ~400,000 points, enough for:

- Business or first-class flights to Europe (e.g. Emirates).

- Time vs reward trade-off

- Managing cards, tracking offers, and staying across rule changes can feel like a part-time job.

- However, for those willing to invest the time, the rewards are described as “well worth it.”

Overall Message

Frequent-flyer programs still offer strong value, especially for premium travel, but:

- The easy wins are gone.

- Success now depends on strategy, timing, and restraint, not just spending.

- Points are best used for luxury travel experiences, not everyday redemptions.

There are three case studies.

1. Someone switched her four home loans to Qantas for 400,000 points per year.

Makes me wonder how much more interest she is paying by doing this.

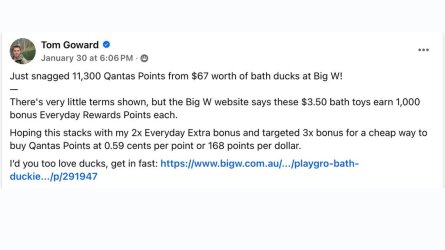

2. Someone earned an undisclosed number of points by buying $2 bath ducks at Big W which earned 2000(?) points each.

I was not aware of this. Has this been mentioned in AFF?

3. Someone flew business class on SQ to Europe for $110.

Typical clickbait headline. Looks like he earned the points from credit card sign ups and he said the annual fees were worth it.

1. Someone switched her four home loans to Qantas for 400,000 points per year.

Makes me wonder how much more interest she is paying by doing this.

2. Someone earned an undisclosed number of points by buying $2 bath ducks at Big W which earned 2000(?) points each.

I was not aware of this. Has this been mentioned in AFF?

3. Someone flew business class on SQ to Europe for $110.

Typical clickbait headline. Looks like he earned the points from credit card sign ups and he said the annual fees were worth it.

RB001

Active Member

- Joined

- Oct 14, 2024

- Posts

- 820

- Qantas

- Platinum

Of course!Has this been mentioned in AFF?

Log in to Facebook

Log in to Facebook to start sharing and connecting with your friends, family and people you know.

www.facebook.com

www.facebook.com

"Each bath toy was on sale for $3.50, and when combined with various other promotions, it worked out to just 0.59 cents per Qantas Point," Flight Hacks founder Immanuel Debeer told Escape.

- futaris

- Replies: 17

- Forum: Qantas | Frequent Flyer

- Joined

- Jul 12, 2018

- Posts

- 1,467

- Qantas

- Bronze

- Virgin

- Platinum

The ducks thing at Big W was the equivalent of the pet food Flybuys promotion from a couple of years ago (which was discussed at the AFF dinner last month).

These were the Everyday Rewards and Flybuys equivalent of "mistake fares" -- poorly thought-through promotions which were then exploited by an eager public (I must admit that I bought several weeks' worth of food for my pets during the Flybuys promotion!).

Needless to say, this has not happened again and to base one's points-collecting strategy on waiting for these sorts of deals would be a mistake!

These were the Everyday Rewards and Flybuys equivalent of "mistake fares" -- poorly thought-through promotions which were then exploited by an eager public (I must admit that I bought several weeks' worth of food for my pets during the Flybuys promotion!).

Needless to say, this has not happened again and to base one's points-collecting strategy on waiting for these sorts of deals would be a mistake!

justinbrett

Enthusiast

- Joined

- Mar 6, 2006

- Posts

- 11,805

- Qantas

- Platinum 1

- Oneworld

- Emerald

Qantas gift cards for Woolworths charged to my QF Amex is my recent hack - use them for all my shopping and get 6.25 points / $ total, plus any EDR bonus points (my calculation is with the Extra subscription).

Even at a low value of 1.6c/point, I'm getting 10% of my grocery spend back as QF points.

In addition before I buy anything from any shop I check and see if QF sells gift cards - Ikea, Harvey Norman, Sheridan, JB Hifi - it's pretty good coverage (and for those I'm getting 5.25 points/$).

Even at a low value of 1.6c/point, I'm getting 10% of my grocery spend back as QF points.

In addition before I buy anything from any shop I check and see if QF sells gift cards - Ikea, Harvey Norman, Sheridan, JB Hifi - it's pretty good coverage (and for those I'm getting 5.25 points/$).

The left side of the third photo states: ‘If a frequent flyer card hit the market offering just 50 or 100 status credits per year, it would be a game changer for travellers struggling to maintain good or platinum tiers’ - pretty funny given such a card already exists! Amex Velocity Platinum offers 50 sc for $25,000 spend and a further 50 sc for a further $25,000 spend per year. And Virgin Money High Flyer Card offers 20% bonus sc on Virgin flights purchased on card. Poorly researched!

Last edited:

Elevate your business spending to first-class rewards! Sign up today with code AFF10 and process over $10,000 in business expenses within your first 30 days to unlock 10,000 Bonus PayRewards Points.

Join 30,000+ savvy business owners who:

✅ Pay suppliers who don’t accept Amex

✅ Max out credit card rewards—even on government payments

✅ Earn & transfer PayRewards Points to 10+ airline & hotel partners

Start earning today!

- Pay suppliers who don’t take Amex

- Max out credit card rewards—even on government payments

- Earn & Transfer PayRewards Points to 8+ top airline & hotel partners

Join 30,000+ savvy business owners who:

✅ Pay suppliers who don’t accept Amex

✅ Max out credit card rewards—even on government payments

✅ Earn & transfer PayRewards Points to 10+ airline & hotel partners

Start earning today!

- Pay suppliers who don’t take Amex

- Max out credit card rewards—even on government payments

- Earn & Transfer PayRewards Points to 8+ top airline & hotel partners

AFF Supporters can remove this and all advertisements

SYD

Enthusiast

- Joined

- Oct 5, 2009

- Posts

- 14,109

- Qantas

- Platinum

- Virgin

- Silver

- Oneworld

- Emerald

- Star Alliance

- Gold

Does your AMEX give bonus QF points for QF Marketplace?Qantas gift cards for Woolworths charged to my QF Amex is my recent hack - use them for all my shopping and get 6.25 points / $ total, plus any EDR bonus points (my calculation is with the Extra subscription).

Even at a low value of 1.6c/point, I'm getting 10% of my grocery spend back as QF points.

In addition before I buy anything from any shop I check and see if QF sells gift cards - Ikea, Harvey Norman, Sheridan, JB Hifi - it's pretty good coverage (and for those I'm getting 5.25 points/$).

I find I get the 2x for flights but not for QF Wine, QF Hotels etc. fortunately, my NAB QF VISA (1pt / $) usually awards 2x points on all QF things.

Interesting how what was $3.50 and 1000 points became $2 and "similar to 2000 points" in the AFR article.Of course!

Log in to Facebook

Log in to Facebook to start sharing and connecting with your friends, family and people you know.www.facebook.com

"Each bath toy was on sale for $3.50, and when combined with various other promotions, it worked out to just 0.59 cents per Qantas Point," Flight Hacks founder Immanuel Debeer told Escape.

- futaris

- Replies: 17

- Forum: Qantas | Frequent Flyer

justinbrett

Enthusiast

- Joined

- Mar 6, 2006

- Posts

- 11,805

- Qantas

- Platinum 1

- Oneworld

- Emerald

Does your AMEX give bonus QF points for QF Marketplace?

I find I get the 2x for flights but not for QF Wine, QF Hotels etc. fortunately, my NAB QF VISA (1pt / $) usually awards 2x points on all QF things.

Yes, it works for marketplace but not for wine (I would have thought it would be the other way around).

RSD

Established Member

- Joined

- Feb 13, 2010

- Posts

- 3,158

- Qantas

- Platinum

Do QF Gift Cards for Woolies earn at a similar rate on a NAB QF Visa? (to what @justinbrett mentioned above of them earning 6.5 points per $ for the gift cards + any EDR points)I find I get the 2x for flights but not for QF Wine, QF Hotels etc. fortunately, my NAB QF VISA (1pt / $) usually awards 2x points on all QF things.

SYD

Enthusiast

- Joined

- Oct 5, 2009

- Posts

- 14,109

- Qantas

- Platinum

- Virgin

- Silver

- Oneworld

- Emerald

- Star Alliance

- Gold

Yes. My NAB QF VISA Signature card generally awards 2x points for any QF purchase.Do QF Gift Cards for Woolies earn at a similar rate on a NAB QF Visa? (to what @justinbrett mentioned above of them earning 6.5 points per $ for the gift cards + any EDR points)

I recently bought an Apple $100 gift card and earned 200 QFF points (plus 1000 on the 10x offer and 10 SCs!)

Whereas, my QF AMEX cards are hit and miss on earning bonus points with QF - other than flights. Hence my question to @justinbrett.

RSD

Established Member

- Joined

- Feb 13, 2010

- Posts

- 3,158

- Qantas

- Platinum

Cheers @SYD - I've got the NAB QF Visa so will have to keep an eye out for offers etc to maximise my earn for my Woolies trips!Yes. My NAB QF VISA Signature card generally awards 2x points for any QF purchase.

I recently bought an Apple $100 gift card and earned 200 QFF points (plus 1000 on the 10x offer and 10 SCs!)

Whereas, my QF AMEX cards are hit and miss on earning bonus points with QF - other than flights. Hence my question to @justinbrett.

justinbrett

Enthusiast

- Joined

- Mar 6, 2006

- Posts

- 11,805

- Qantas

- Platinum 1

- Oneworld

- Emerald

Whereas, my QF AMEX cards are hit and miss on earning bonus points with QF - other than flights. Hence my question to @justinbrett.

Lots of evidence in addition to my own that it applies to marketplace purchases.

Regardless of what the T&Cs say…

Is there any restriction on the number of gift cards purchased?Qantas gift cards for Woolworths charged to my QF Amex is my recent hack - use them for all my shopping and get 6.25 points / $ total, plus any EDR bonus points (my calculation is with the Extra subscription).

Even at a low value of 1.6c/point, I'm getting 10% of my grocery spend back as QF points.

In addition before I buy anything from any shop I check and see if QF sells gift cards - Ikea, Harvey Norman, Sheridan, JB Hifi - it's pretty good coverage (and for those I'm getting 5.25 points/$).

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.