- Joined

- Jun 18, 2002

- Posts

- 1,557

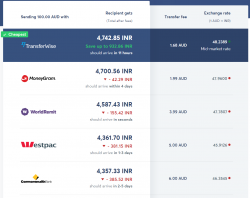

As a frequent flyer, the chances are that you often travel overseas and need foreign currency. You also know that the traditional ways of getting foreign currency is expensive, coughbersome and slow. Banks and credit card companies usually add their own margin on top of the real exchange rate PLUS that dreaded foreign exchange fee. But this model has now changed…

...enter TransferWise a revolutionary new way to transfer money and make international transfers with transparent pricing, the real exchange rate, and no hidden fees!

A truly “borderless” account

Your TransferWise account is a multi-currency account. You can hold over 40 different currencies in your account and transfer money between these currencies at the real exchange rate (plus a small, fully-disclosed fee). And there's more:

... you also get a free Platinum debit Mastercard also comes with free overseas ATM withdrawals of up to $350 every 30 days

... plus you get your own AUD, NZD, USD, GBP and EUR bank accounts so you can receive and spend these currencies at no cost!

TransferWise is perfect for frequent overseas travellers, Australians living abroad or anyone that needs to make or receive payments in a foreign currency.

...enter TransferWise a revolutionary new way to transfer money and make international transfers with transparent pricing, the real exchange rate, and no hidden fees!

A truly “borderless” account

Your TransferWise account is a multi-currency account. You can hold over 40 different currencies in your account and transfer money between these currencies at the real exchange rate (plus a small, fully-disclosed fee). And there's more:

... you also get a free Platinum debit Mastercard also comes with free overseas ATM withdrawals of up to $350 every 30 days

... plus you get your own AUD, NZD, USD, GBP and EUR bank accounts so you can receive and spend these currencies at no cost!

TransferWise is perfect for frequent overseas travellers, Australians living abroad or anyone that needs to make or receive payments in a foreign currency.