You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Is the Qantas Premier Platinum historically a good offer? 100k points for $199 fee

- Thread starter brad1549

- Start date

- Status

- Not open for further replies.

Solution

Don't forget that you also currently get 75 status credits.

This is pretty much as good as the offers get for this card. When I applied earlier this year it was 80k points + 75 status credits, and I had to pay the full annual fee. I don't think the offer on this card has even gone above 100,000 Qantas points.

This is pretty much as good as the offers get for this card. When I applied earlier this year it was 80k points + 75 status credits, and I had to pay the full annual fee. I don't think the offer on this card has even gone above 100,000 Qantas points.

- Joined

- Aug 21, 2011

- Posts

- 15,017

- Qantas

- Platinum

- Virgin

- Platinum

- SkyTeam

- Elite Plus

- Star Alliance

- Gold

Don't forget that you also currently get 75 status credits.

This is pretty much as good as the offers get for this card. When I applied earlier this year it was 80k points + 75 status credits, and I had to pay the full annual fee. I don't think the offer on this card has even gone above 100,000 Qantas points.

This is pretty much as good as the offers get for this card. When I applied earlier this year it was 80k points + 75 status credits, and I had to pay the full annual fee. I don't think the offer on this card has even gone above 100,000 Qantas points.

- Joined

- Feb 23, 2015

- Posts

- 5,065

- Qantas

- Platinum

- Virgin

- Platinum

- Star Alliance

- Gold

They've definitely done equivalent 120k bonuses before - split into 20k points for $1.5k spend per month over 6 months.

I can't remember a 120k bonus for $x,000 over 3 months or the first year annual fee being less than $199.

I'd say the current deal is pretty good.

I can't remember a 120k bonus for $x,000 over 3 months or the first year annual fee being less than $199.

I'd say the current deal is pretty good.

The Frequent Flyer Concierge team takes the hard work out of finding reward seat availability. Using their expert knowledge and specialised tools, they'll help you book a great trip that maximises the value for your points.

AFF Supporters can remove this and all advertisements

QF_Flyer

Member

- Joined

- Oct 26, 2017

- Posts

- 369

- Qantas

- Platinum

- Virgin

- Platinum

- Oneworld

- Emerald

- Star Alliance

- Gold

The current deal does look pretty much up there, iirc it ends towards the end of Feb, I’m planning to go for it at the end of Feb, so the SCs roll into next year if possible.

- Joined

- Feb 23, 2015

- Posts

- 5,065

- Qantas

- Platinum

- Virgin

- Platinum

- Star Alliance

- Gold

The current deal does look pretty much up there, iirc it ends towards the end of Feb, I’m planning to go for it at the end of Feb, so the SCs roll into next year if possible.

When's your anniversary? The SC will probably roll into next year anyway based on the recently announced status support.

QF_Flyer

Member

- Joined

- Oct 26, 2017

- Posts

- 369

- Qantas

- Platinum

- Virgin

- Platinum

- Oneworld

- Emerald

- Star Alliance

- Gold

28/2, so I was leaving it as late as possible! WP so was planning on maybe 600 SS+100PC+, then 75 from this? Nice head start for 2023.When's your anniversary? The SC will probably roll into next year anyway based on the recently announced status support.

- Joined

- Feb 23, 2015

- Posts

- 5,065

- Qantas

- Platinum

- Virgin

- Platinum

- Star Alliance

- Gold

28/2, so I was leaving it as late as possible! WP so was planning on maybe 600 SS+100PC+, then 75 from this? Nice head start for 2023.

Gotcha, it would really depend on how quickly you will hit the minimum spend, but I'd be inclined to apply in late Jan/early Feb.

QF_Flyer

Member

- Joined

- Oct 26, 2017

- Posts

- 369

- Qantas

- Platinum

- Virgin

- Platinum

- Oneworld

- Emerald

- Star Alliance

- Gold

Good call. I have a few bills due in Feb, so will assess the situation after Xmas and work it out one way or another!Gotcha, it would really depend on how quickly you will hit the minimum spend, but I'd be inclined to apply in late Jan/early Feb.

oznflfan

Active Member

- Joined

- Apr 15, 2020

- Posts

- 861

Good offer, just got approved myself a week ago. Min spend easy with school fees paid in advance. Lounge passes good. Don't care about Status myself. Gotta build back points, under 300K in my balance right now. Just spent 24K on Melbourne 5 night return mid March for Round 1 AFL. Will be first flight since Dec 2019. Can't wait.

- Joined

- Nov 1, 2011

- Posts

- 1,419

- Qantas

- Gold

- Virgin

- Gold

Is there another forum or thread somewhere on here that goes over current offers? I am nearing the 1 year mark on my QF Premier Platinum and looking at options to see if I should churn.

- Joined

- Feb 23, 2015

- Posts

- 5,065

- Qantas

- Platinum

- Virgin

- Platinum

- Star Alliance

- Gold

Is there another forum or thread somewhere on here that goes over current offers?

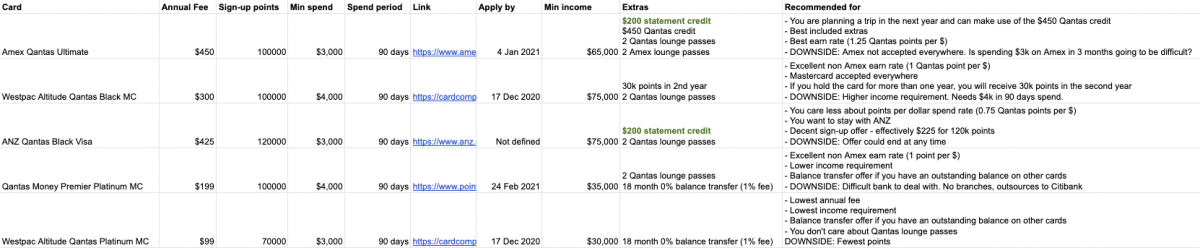

There are individual bank forums here and more general credit card promotions here, but it can be difficult to see a succinct list of all current offers. Certain cards have threads which span back multiple years and with thread titles that are no longer current.

A friend who wants to get into churning (but doesn't pump heaps of money through their card) recently asked me for a summary of offers, I gave them this (note the Westpac bonus numbers inc the 10k referral promo, check my sig for more details)

I am nearing the 1 year mark on my QF Premier Platinum and looking at options to see if I should churn.

The answer to this is usually yes.

Last edited:

- Joined

- Dec 31, 2011

- Posts

- 10,131

- Qantas

- Platinum

- Virgin

- Gold

28/2, so I was leaving it as late as possible! WP so was planning on maybe 600 SS+100PC+, then 75 from this? Nice head start for 2023.

I don't believe the 600 SS SC roll over.

QF_Flyer

Member

- Joined

- Oct 26, 2017

- Posts

- 369

- Qantas

- Platinum

- Virgin

- Platinum

- Oneworld

- Emerald

- Star Alliance

- Gold

One note here, the ANZ QF Black is 1 QF/$1, which makes it significantly more attractive that it would otherwise be. Westpac Black is 0.75/$1. Good summary though.There are individual bank forums here and more general credit card promotions here, but it can be difficult to see a succinct list of all current offers. Certain cards have threads which span back multiple years and with thread titles that are no longer current.

A friend who wants to get into churning (but doesn't pump heaps of money through their card) recently asked me for a summary of offers, I gave them this (note the Westpac bonus numbers inc the 10k referral promo, check my sig for more details)

View attachment 235730

The answer to this is usually yes.

Post automatically merged:

No, but I won’t get them until March and am already extended until Feb 2022, so Mar 2021-Feb 2022 will be for my 22-23 status year.I don't believe the 600 SS SC roll over.

- Joined

- Feb 23, 2015

- Posts

- 5,065

- Qantas

- Platinum

- Virgin

- Platinum

- Star Alliance

- Gold

One note here, the ANZ QF Black is 1 QF/$1, which makes it significantly more attractive that it would otherwise be. Westpac Black is 0.75/$1. Good summary though.

ARGH I mixed up the earn rates on the ANZ and Westpac cards...

Post automatically merged:

I don't believe the 600 SS SC roll over.

You are correct, but it sounds like @guesswho2000 has a Feb anniversary, which means they will get the 600 SC Status Support BUT no Status Support rollover.

- Joined

- Apr 1, 2009

- Posts

- 19,098

- Qantas

- LT Gold

- Oneworld

- Sapphire

This is a card I am also likely to apply for in January/February, with the goal of making my first purchase (and the qualifying spend) in March to make sure the 75 SC ends up in my new membership year (also 28/2 anniversary). If I manage one more flight I'll also have a bonus 50 SC waiting to credit, resulting in a WP re-qual of only 475 SC (600 + 75 + 50). With Points Club this should be fairly easy

stig_aus

Intern

- Joined

- Feb 14, 2018

- Posts

- 95

- Qantas

- Gold

- Virgin

- Platinum

Has anybody had any difficulty in applying for this card? I've never had trouble with an application before but was automatically rejected shortly after applying (no issues with credit history, current total card limits are low and ability to repay is fine). Spoke to the call center and they said they would manually review the application (suggesting that nobody actually looked at it in the first instance), but this seems a little strange to me.

Welcome to Citi....but this seems a little strange to me.

stig_aus

Intern

- Joined

- Feb 14, 2018

- Posts

- 95

- Qantas

- Gold

- Virgin

- Platinum

It seems that way. Had the re-assessment also nearly instantly rejected with no explanation as they “don’t discuss their lending criteria”.Welcome to Citi.

Super weird.

Is it worth pursuing with their complaints department or should I just drop it? I guess they have a right to judge anyone as a risk for whatever reason they choose really.

I’m not sure if anyone has actually managed to work out the mysterious world of Citi. You can generally expect robotic responses from prepared scripts.It seems that way. Had the re-assessment also nearly instantly rejected with no explanation as they “don’t discuss their lending criteria”.

Super weird.

Is it worth pursuing with their complaints department or should I just drop it? I guess they have a right to judge anyone as a risk for whatever reason they choose really.

Those with some sort of relationship with Citi (e.g., Citi Gold/Wealth Management) would expect to do better.

Something has triggered the quick rejection. Have you checked your credit report recently, to make sure that all’s good? Not too many credit card applications in the past 12 months or so? Declared your current credit cards? Not carrying a large amount of credit card debt?

If you find nothing obvious, maybe request a review of your application. Not to say that you will get any sense out of them. Not worth going down the complaint path.

Last edited:

Economy_Gold

Member

- Joined

- Nov 11, 2010

- Posts

- 106

- Qantas

- Platinum

If you find nothing obvious, maybe request a review of your application. Not to say that you will get any sense out of them. Not worth going down the complaint path.

I got this card successfully, but I too have learned over the years that "it's Citi" is an important component of dealing with them. Their criteria are mysterious and it is not worth making a complaint as they have every right to select their customers.

- Status

- Not open for further replies.

Enhance your AFF viewing experience!!

From just $6 we'll remove all advertisements so that you can enjoy a cleaner and uninterupted viewing experience.And you'll be supporting us so that we can continue to provide this valuable resource :) Sample AFF with no advertisements? More..

Sample AFF with no advertisements? More..

Sample AFF with no advertisements? More..

Sample AFF with no advertisements? More..Recent Posts

-

-

A unique benefit of status with Royal Air Maroc

- Latest: encryptededdy

-

-

Staff online

-

JessicaTamEnthusiast

-

NMEnthusiast

Currently Active Users

- AIRwin

- encryptededdy

- CorporateFlyerMEL

- kpc

- fly2earth

- Harrison_133

- RichardMEL

- Doug_Westcott

- 1erCru

- blackcat20

- swellington

- olorinn

- wenglock.mok

- brissie

- Albert Hoffman

- MrsKing

- sudoer

- Moy

- velli25

- GDSman

- Yearlylonghaul

- tim84

- _TheTraveller_

- RSD

- jase05

- Franky

- Warragul

- cory

- luxury-lizard

- http_x92

- Mac502

- JessicaTam

- Vipers

- paddywide

- djkelly69

- VantageXL

- Stone

- mccaffd

- Pete98765432

- AussieTim

- PERLHR

- xen0n33

- mouseman99

- tomlee1986

- nige_perth

- pm3207

- nancypants

- defurax

- Thomas088

- TedE

- NM

Total: 1,111 (members: 85, guests: 1,026)