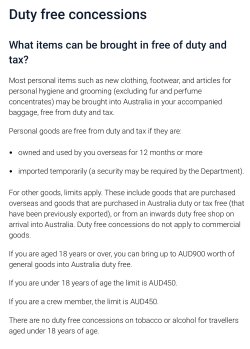

I think the wording on ABF own website makes it less than helpful.

Firstly - they say MOST personal clothing can be brought in duty free …..then this only applies to a $900 limit (which barely covers much).

Park aside the ‘more than 12 months old’ which is exempt.

View attachment 441841

I am happy to do the right thing but are my battered runners (bought for $300 and worn for a month overseas worth $300)? Are they ‘new clothing anymore’ - I dont think so.. others may think differently. I do struggle with this as do HLO, donate clothes along the way and wear things I buy.

If in doubt declare, those queues are going to get much longer.

I know pax say ABF ‘aren’t interested’ in these mere trifles but unless you go through the threshold process you wont know that.

If I take my designer clothing overseas and wear it whats to stop them asking did you buy it there? (Note to self being receipts).

Personally I never do TRS as cant be bothered with