- Joined

- May 25, 2013

- Posts

- 1,800

Do you take cover for NZ?

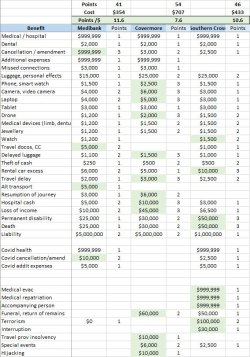

I have NZ, Europe and SG coming, separate trips but all in about 10 week timeframe. Possibly also adding the likes of Korea/Japan in March and definitely another Europe in June. At the minimum, this would be EU + SG + EU in the next 9 months and I'm thinking of whether it'd make sense to combine time into a single annual policy or take out individual ones, as needed?

I have NZ, Europe and SG coming, separate trips but all in about 10 week timeframe. Possibly also adding the likes of Korea/Japan in March and definitely another Europe in June. At the minimum, this would be EU + SG + EU in the next 9 months and I'm thinking of whether it'd make sense to combine time into a single annual policy or take out individual ones, as needed?