I bank with ING and off to the US in August with the family. Will just use my ING based on the rebate fees on international trx. Seems like the easiest option for us without having to apply somewhere else just for this trip....or transfer money onto our QF FF card like we did last OS holiday

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Best card with no forex fees

- Thread starter Kscf

- Start date

- Status

- Not open for further replies.

Really important point and worth emphasizing, particularly having gone to the effort of using a fx "free" card. OT, but saw this terrible option when using AU card on US Amazon account, can't remember if this was the default option.Always decline this service and insist your card is charged in the local currency

albatross710

Established Member

- Joined

- May 15, 2004

- Posts

- 3,843

We are also heading off soon. For travel, I requested two new separate ING cards for Mrs Albatross and I with separate accounts. We have a small number of direct debits linked to the joint card we use here in Au. My theory is that if we are travelling and one of us loses our regualr joint card we could find both of us locked out of the account and then ING will issue new cards and numbers and some of the DDs will fail. I'm hoping that this dual card/dual account idea will work for the bulk of cash withdrawals.I bank with ING and off to the US in August with the family. Will just use my ING based on the rebate fees on international trx. Seems like the easiest option for us without having to apply somewhere else just for this trip....or transfer money onto our QF FF card like we did last OS holiday

My card strategy is

2 ING cards in separate names

1 WISE card (1 carry)

1 ME Bank card for hotel holding deposit and rental car use (Mr Albatross carries)

1 Citibank debit card for emergency transfers (left in luggage)

SYD

Enthusiast

- Joined

- Oct 5, 2009

- Posts

- 14,015

- Qantas

- Platinum

- Virgin

- Silver

- Oneworld

- Emerald

- Star Alliance

- Gold

Presumably you’ll be back before August?We are also heading off soon. For travel, I requested two new separate ING cards for Mrs Albatross and I with separate accounts. We have a small number of direct debits linked to the joint card we use here in Au. My theory is that if we are travelling and one of us loses our regualr joint card we could find both of us locked out of the account and then ING will issue new cards and numbers and some of the DDs will fail. I'm hoping that this dual card/dual account idea will work for the bulk of cash withdrawals.

My card strategy is

2 ING cards in separate names

1 WISE card (1 carry)

1 ME Bank card for hotel holding deposit and rental car use (Mr Albatross carries)

1 Citibank debit card for emergency transfers (left in luggage)

ING Bank Dropping 5 ATM Operator Fee Rebate Benefit from 1/8/23

It was good while it lasted. Fortunately cash is no longer king in many places. Maybe the occasional $3 ATM fee is not a big deal but I’ll explore options beyond others I already have. Including withdrawing USD while I’m here now! 😁 I’ll still be keeping ING for the Savings Maximiser. Still...

www.australianfrequentflyer.com.au

www.australianfrequentflyer.com.au

No change to normal VISA debit transaction at least.

albatross710

Established Member

- Joined

- May 15, 2004

- Posts

- 3,843

sadly will be back.Presumably you’ll be back before August?

ING Bank Dropping 5 ATM Operator Fee Rebate Benefit from 1/8/23

It was good while it lasted. Fortunately cash is no longer king in many places. Maybe the occasional $3 ATM fee is not a big deal but I’ll explore options beyond others I already have. Including withdrawing USD while I’m here now! 😁 I’ll still be keeping ING for the Savings Maximiser. Still...www.australianfrequentflyer.com.au

No change to normal VISA debit transaction at least.

Lost Redditor

Member

- Joined

- Mar 21, 2023

- Posts

- 399

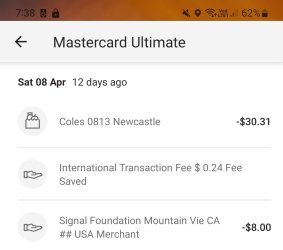

I've been using the CommBank Ultimate card for a while and can confirm I've saves lots of forex using this card. It's the first card I've had that does this. It also shows the savings in the statements and list of transactions. Keep wanting to close it but I quite like it (because i churn). The card also looks very sleek, people ask me about it and I always joke it's like the AMEX Black, just need a minimum spend of $500,000/year, anyone can get one

Attachments

SYD

Enthusiast

- Joined

- Oct 5, 2009

- Posts

- 14,015

- Qantas

- Platinum

- Virgin

- Silver

- Oneworld

- Emerald

- Star Alliance

- Gold

ING does that. When using the debit function, it shows the Int Tx Fee followed by a “Rebate” line item.I've been using the CommBank Ultimate card for a while and can confirm I've saves lots of forex using this card. It's the first card I've had that does this. It also shows the savings in the statements and list of transactions. Keep wanting to close it but I quite like it (because i churn). The card also looks very sleek, people ask me about it and I always joke it's like the AMEX Black, just need a minimum spend of $500,000/year, anyone can get one

- Joined

- Dec 18, 2020

- Posts

- 521

- Virgin

- Platinum

- Oneworld

- Sapphire

- Star Alliance

- Gold

This is not financial advice etc etc etcHi All,

I have a 3 week overseas trip coming up. I still have my US amex cards but not much money left in US bank accounts

Should I transfer the money from AUD to USD and lose a bunch in the fx conversions , fees and what not and earn some good points or apply for a good AU card with no forex fees or use my AU amex card.

Anticipated spend is $12-$15k AUD

But why would you - ever - use your own money? If it were me, I’d put everything I possibly could on my US Amex and cop the fees on whatever I used when Amex wasn’t accepted.

You enjoy so many more protections when using a credit card rather than anything else

I have no interest in QF FF points - you may - because they are almost impossible to redeem for anything that you actually want at the time you actually want want it. So, IMHO, the CBA card is pointless. I had it for about 4ths and gave it back after I got the SUB. Most Australian cc have woeful redemption rates (other than Amex)

I’ve never ‘done the maths’ as such (because I can’t be bothered) but with the CBA Ultimate I figured I have to spend $14000 to make the annual fee worthwhile given that my non-Amex spend goes on my HSBC Star Alliance card (so I would have to pay the ultimate fee)

You can transfer to USD at very favourable rates using Wise. That would be my choice

I have been using the Bankwest World credit card for many overseas trips. it comes with no forex fees and it is very close to the XE.com rate. There is also a platinum debit transaction card that you can preload your money for ATM withdrawals and only pay for the ATM fee.

SYD

Enthusiast

- Joined

- Oct 5, 2009

- Posts

- 14,015

- Qantas

- Platinum

- Virgin

- Silver

- Oneworld

- Emerald

- Star Alliance

- Gold

Does the debit card support foreign currencies or are you just parking AUD? If the latter, there are other products (eg ING, UBank etc) that allowI have been using the Bankwest World credit card for many overseas trips. it comes with no forex fees and it is very close to the XE.com rate. There is also a platinum debit transaction card that you can preload your money for ATM withdrawals and only pay for the ATM fee.

You to move money as required and access ATMs fee free (other than any local ATM fee).

If the debit cards supports foreign currencies, does it charge a commission at time of conversion - like Westpac’s (so you’re not much better off)?

I think I have been second guessing myself. I plan to just take my ING AU debit card as my main form of payment as the international trx fee is rebated back. Will have a good portion of US cash in hand so if we need to withdraw money out of an ATM I am not really concerned about the fee for that withdrawal. I don't see us withdrawing cash everyday where the fees would stack up.I bank with ING and off to the US in August with the family. Will just use my ING based on the rebate fees on international trx. Seems like the easiest option for us without having to apply somewhere else just for this trip....or transfer money onto our QF FF card like we did last OS holiday

Am I missing anything with why people who have ING debit card also get a stand alone travel card? Not really concerned with 1-3c difference between bank providers currency rate provide. Can someone put my mind at ease that I am not silly in thinking my ING debit card will suffice?

I will also have my AU credit card as back up but doubt will need it. Airbnb is paid for already and will just need to use it for the car hire hold Avis will put on.

SYD

Enthusiast

- Joined

- Oct 5, 2009

- Posts

- 14,015

- Qantas

- Platinum

- Virgin

- Silver

- Oneworld

- Emerald

- Star Alliance

- Gold

I can’t imagine why any regular traveller would use a “travel card”!I think I have been second guessing myself. I plan to just take my ING AU debit card as my main form of payment as the international trx fee is rebated back. Will have a good portion of US cash in hand so if we need to withdraw money out of an ATM I am not really concerned about the fee for that withdrawal. I don't see us withdrawing cash everyday where the fees would stack up.

Am I missing anything with why people who have ING debit card also get a stand alone travel card? Not really concerned with 1-3c difference between bank providers currency rate provide. Can someone put my mind at ease that I am not silly in thinking my ING debit card will suffice?

I will also have my AU credit card as back up but doubt will need it. Airbnb is paid for already and will just need to use it for the car hire hold Avis will put on.

But yes, so long as you’ve met the monthly hurdles, the ING Debit card is still a very good option for day to day purchases and ATM rebates until August. But even after that, you’ll still have access to your cash - just find an ATM with US$3 or less fee.

Definitely carry a CC for car rentals and hotel authorisations.

stm1sydney

Established Member

- Joined

- Mar 31, 2018

- Posts

- 1,104

I'm pretty sure no-one on this thread has a standalone travel card, so you are not missing anything. We all know they are a rip-off. A debit card eg Citi or ING for ATM cash withdrawals (plus a backup card) and a c/c eg 28 degrees for credit transactions (plus a backup).Am I missing anything with why people who have ING debit card also get a stand alone travel card? Not really concerned with 1-3c difference between bank providers currency rate provide. Can someone put my mind at ease that I am not silly in thinking my ING debit card will suffice?

I will also have my AU credit card as back up but doubt will need it. Airbnb is paid for already and will just need to use it for the car hire hold Avis will put on.

I am investigating Wise for a trip to Japan in a few months. Can you advise what product you are using? Is it the debit card account with both a digital and physical card? Is the debit card a visa branded one which can be used everywhere with paywave? Does the physical card swipe in the machines ok? And does the $AUD350 limit before a fee being charged only apply to ATM withdrawals? So that you could use the digital/physical card as much as you want with out any fee? (Except for the initial fx fee to fund the account). The rates look very attractive.Agree. Wise is one of several cards we are currently using in Japan.

Buzzard

Senior Member

- Joined

- Jan 22, 2013

- Posts

- 7,007

I can answer some questions @Pele but best you check the Wise website.

The card is a Visa debit. I'm not into debit or credit card apps so only use physical cards. I have only used the card in Japan. Mostly I could just tap but at some places it was insert and PIN.

Only once did I use it to withdraw cash so I didn't exceed any limits.

Nowhere did I have any problems using the card. I'm glad I got it.

The card is a Visa debit. I'm not into debit or credit card apps so only use physical cards. I have only used the card in Japan. Mostly I could just tap but at some places it was insert and PIN.

Only once did I use it to withdraw cash so I didn't exceed any limits.

Nowhere did I have any problems using the card. I'm glad I got it.

SYD

Enthusiast

- Joined

- Oct 5, 2009

- Posts

- 14,015

- Qantas

- Platinum

- Virgin

- Silver

- Oneworld

- Emerald

- Star Alliance

- Gold

What sort of difference are you seeing?I'm off to India then Finland this week. En route to Lord's.

Planning to give Revolut a whirl.

Beats Ozfx, citi debit handsomely and the big 4 by a mile, on a trial conversion.

The other day I did an actual side by side comparison with a bunch of cards that I have. Topped up my Oyster card* in £5 increments.

The XE spot rate was about A$9.29

$9.33 - 28° MC

$9.33 - Citi (MC Debit)

$9.61 - WBC WW (MC Debit)**

$9.35 - ING (VISA debit)

$9.35 - UBank (VISA debit)

With the exception of the disappointing Westpac product, not a lot in it. I ran out of time but I suspect my NAB Platinum VISA debit would have come through the same as ING and UBank.

I believe the diff between MC and VISA is a function of spot rate v overnight overnight rate - which can be “swings and roundabouts”.

*Yes, I know you can use a debit / CC on TFL but the Oyster is good for dumping coins and cash.

**I transferred AUD to the WBC WW card rather than converting to £ but you just get stung the 3% conversion on transaction. I’m also going to do a small ATM withdrawal to decide if this is useless - despite the hype in the PDS.

albatross710

Established Member

- Joined

- May 15, 2004

- Posts

- 3,843

I used the physical the AppleWallet cars while travelling. Worked well for me.I am investigating Wise for a trip to Japan in a few months. .... Is it the debit card account with both a digital and physical card? Is the debit card a visa branded one which can be used everywhere with paywave? ....And does the $AUD350 limit before a fee being charged only apply to ATM withdrawals?

The $350 limit only applies to ATM cash withdrawals. After the $350 limit it's the same as other cards for cash.

luckypierre

Member

- Joined

- Feb 20, 2009

- Posts

- 392

- Qantas

- Qantas Club

- Virgin

- Platinum

Used the Wise physical card in Uk this year as a swipe or tap debit card only. You will also gave access to a digital card, which in my case I left “frozen” , but handy to have available if the physical card doesn’t work.I am investigating Wise for a trip to Japan in a few months. Can you advise what product you are using? Is it the debit card account with both a digital and physical card? Is the debit card a visa branded one which can be used everywhere with paywave? Does the physical card swipe in the machines ok? And does the $AUD350 limit before a fee being charged only apply to ATM withdrawals? So that you could use the digital/physical card as much as you want with out any fee? (Except for the initial fx fee to fund the account). The rates look very attractive.

Within the Wise App you can convert AUD to various currencies, especially when exchange rates are good Though in the last year not a lot of +- variation for Euros and UK pounds.

The main credit card we used was 28 degrees, with other CCs as backups.

- Status

- Not open for further replies.

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- larry40

- JessicaTam

- AIRwin

- Willpanzer

- martindagun

- tgh

- Beachy55

- frodo

- dandandan

- mms498

- nj12

- Milemuncher

- Austman

- RooFlyer

- im.daniel

- jase05

- Staph

- QFFHntrGthr

- kamchatsky

- hydrabyss

- AshM

- Cottman

- Beer_budget

- Seat0B

- Harrison_133

- Mattg

- The Man in Blue

- jeza

- funnybrus

- Noel Mugavin

- Duggo

- albyd

- Lukerayment

- kuwahshi

- Kristian

- Scarlett

- tielec

- SydneySwan

- Oubline

- Doug_Westcott

- SheikYerbouti

- MooTime

- Dr Ev

- Aeryn

- Dr_Goz

- louis.1996

- pauldab

- vhojm

- Foz

- WrenchHammerMcTool

Total: 1,524 (members: 73, guests: 1,451)