SYD

Enthusiast

- Joined

- Oct 5, 2009

- Posts

- 14,300

- Qantas

- Platinum

- Virgin

- Silver

- Oneworld

- Emerald

- Star Alliance

- Gold

I would prefer the option to opt out at the card level so it never pops up.That's not right either. I don't want to be presented with that choice each time I make a purchase. I have to keep telling them to charge in THB and when wife is around they confirm with her that I dont want to be charged in AUD.

If they are really providing a service then it should be switched off as a default and if you want this service to switch it on. Same as international roaming. Ours is switched off by default.

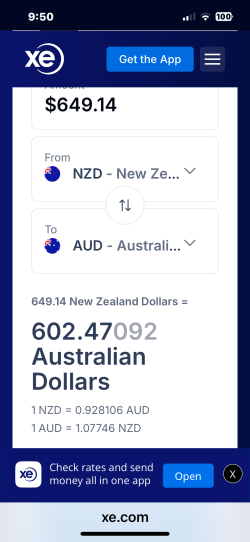

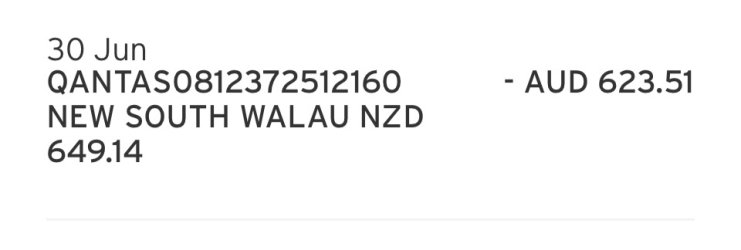

I can’t imagine a single scenario where I would be better off using DCC.

Fortunately it’s getting more coverage in the mainstream media and hopefully that helps promote the illegitimate nature of DCC. Another article just today!

“The dynamic currency conversion trap”

Fees and scams: Eight things to know about using credit cards overseas

Scammers lie in wait, and if you use the wrong card you could end up paying more than you need to.