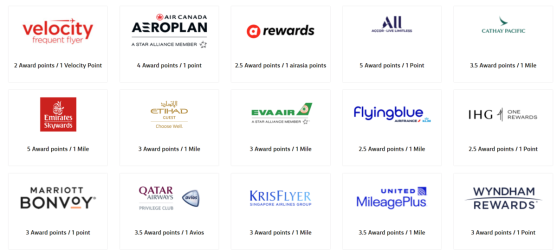

I think the biggest upside of a program with so many transfer partners, but rubbish transfer rates, is that it may be useful for truly global travellers.

There's more to loyalty than the big names like Qantas, Velocity, KrisFlyer etc. They all have their upsides, but so do others. So those who take a more advanced and strategic approach to miles might choose to build a balance in some offshore program somewhere - and one you can't usually top up by a simple transfer.

Winding the clock back a few years, I had a good balance of United miles - enough for a business class long-haul, but just a tad short of first class. Had I been able to simply convert credit card points, even at a poor rate, I'd have loved that simplicity to close that gap. Sure, it wouldn't make sense to convert credit card points in that way to start from zero, but if it's just a little top-up here and there, having the option can be quite useful. (Instead I had to shift around some hotel points from places like Hyatt and Marriott to get my United account high enough for the redemption, as it didn't make sense to buy in a relatively small quantity.)

But yeah, with CBA really being more of a mainstream program, the article really hits the nail on the head. People expect clarity, notice, and information. Right now, CBA isn't delivering that, and the allure of the hard-to-get foreign transfers is outweighed by failing with the basics.

www.australianfrequentflyer.com.au

www.australianfrequentflyer.com.au