prozac

Senior Member

- Joined

- Jan 7, 2010

- Posts

- 6,173

*As indicated in a post above the fee free first year has been dropped from the amex offer.*

However the card easily pays for itself over and over in credits back to your account so even with the annual fee is great value. I have received around $400 back in the past 3 weeks and today enrolled in a few more that will see me get more credits for buying gift cards at Supercheap Auto and Rebel Sport amongst others.

As Local Champion at my regular Coles I am still receiving 4 points per dollar spend.

What's not to love?

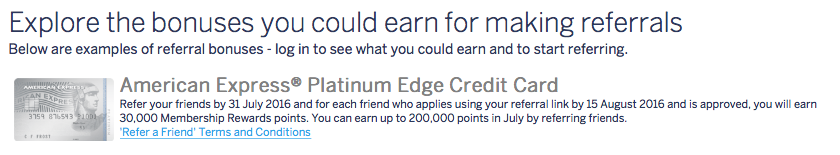

If interested this is the New Link HERE. Note that I will receive points as the referrer.

Happy to answer any questions by pm regarding this card.

However the card easily pays for itself over and over in credits back to your account so even with the annual fee is great value. I have received around $400 back in the past 3 weeks and today enrolled in a few more that will see me get more credits for buying gift cards at Supercheap Auto and Rebel Sport amongst others.

As Local Champion at my regular Coles I am still receiving 4 points per dollar spend.

What's not to love?

If interested this is the New Link HERE. Note that I will receive points as the referrer.

Happy to answer any questions by pm regarding this card.