This one belongs in that “what cheeses me off” thread…

The UK’s pretty much contactless payments everywhere these days, so I haven’t needed physical cash at all. But Azmar, our Middle Eastern feast the other day, was “cash only”. So off I went to the M&S bank cashpoint off Oxford Street to get some real money. After safely navigating through the offer of Dynamic Currency Conversion, I hit the final screen, where the machine suddenly announced it was going to charge a fee of £3.95.

No thanks, I thought, and cancelled the transaction. Walked back to Bond Street to a proper bank (Lloyd’s), and used their machine with no fees. Sorted. Or so I thought…

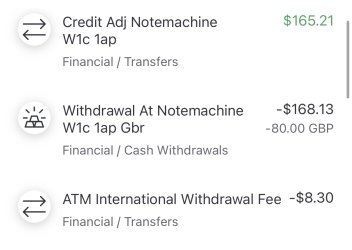

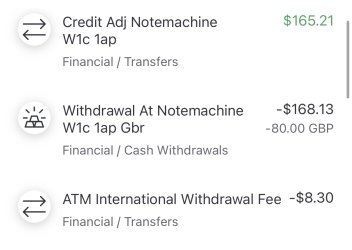

Cut to a few days later checking my account (Macquarie Bank, which has no intl fees on its debit card). Turns out good old M&S bank processed the transaction regardless, then refunded it, costing me the value of the buy/sell spread ($2.92) and then just went ahead and slung me their fee anyway.

I mean we’re talking $11.22 here, but it’s a principle. Why should I be charged for no service, and how was I supposed to know about the fee if you didn’t tell me about it until it was too late to avoid it?

I have submitted a dispute through Macquarie, so we’ll see what happens…