NVRENUF

Intern

- Joined

- Jan 20, 2015

- Posts

- 70

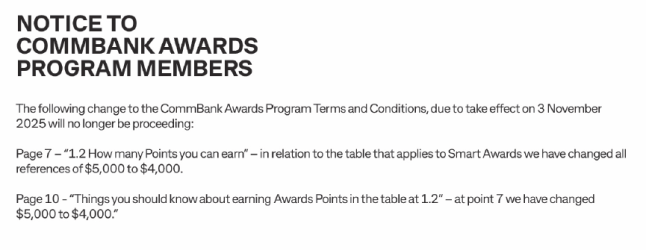

oh that's great, thank you for the reply. As this card is good for no international fees and fantastic when over seas. So i really didn't want to change it.No Qantas is not a flexible transfer partner. Qantas direct will remain, there is no change to any direct Qantas earning cards.

Thank you