its 2025, and I over the past 10 years have collected a lot of points,

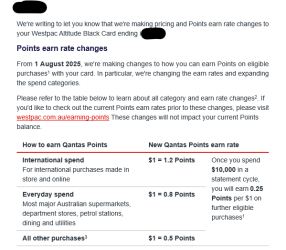

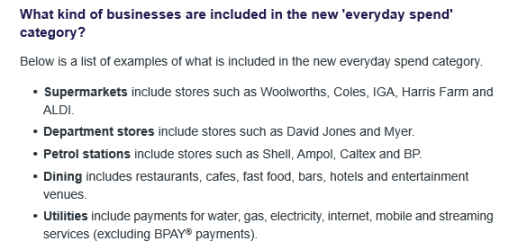

Unless you have a business or have a unique situation where you get frequent flyer miles/points for free or your work pays for it, i am now finding it not worth chasing any more

eg Amex points went from 2-3 points per $1 spend to 1.5-2, then conversion rates to various programs rates dropped by 25-33%

Credit card churning periods have now increased from 12 to 18-24 months periods

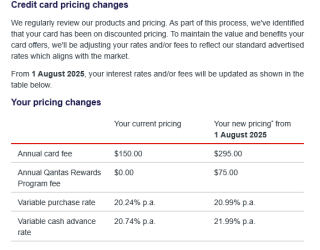

Credit card annual fees have gone up

Most merchants are now charging credit card surcharge fees which were not that common pre covid

Many years ago i used to buy heaps of supermarket gift cards, solely for the points,

sometimes payall/sniip etc was worth it for me

I used to buy local shopping centre gift cards because the fee was say $7 per $1000

I used to pay every bill using cards

Now, I dont do most of them and have virtually stopped,

I cant see the market returning to its old glory, but is it just a "dead" market now?

Unless you have a business or have a unique situation where you get frequent flyer miles/points for free or your work pays for it, i am now finding it not worth chasing any more

eg Amex points went from 2-3 points per $1 spend to 1.5-2, then conversion rates to various programs rates dropped by 25-33%

Credit card churning periods have now increased from 12 to 18-24 months periods

Credit card annual fees have gone up

Most merchants are now charging credit card surcharge fees which were not that common pre covid

Many years ago i used to buy heaps of supermarket gift cards, solely for the points,

sometimes payall/sniip etc was worth it for me

I used to buy local shopping centre gift cards because the fee was say $7 per $1000

I used to pay every bill using cards

Now, I dont do most of them and have virtually stopped,

I cant see the market returning to its old glory, but is it just a "dead" market now?

Last edited: