You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

AFF Member Stock Discussion

- Thread starter samh004

- Start date

- Joined

- Jun 1, 2014

- Posts

- 5,457

I’d be happy with manufactured diamond.IDK why people..

Natural diamonds are a product of Gaia and the flaws are a plus over sterile perfection

My Platinum is manufactured.

As was my Gold before that.

Quickstatus

Enthusiast

- Joined

- Oct 13, 2013

- Posts

- 17,386

I think manufactured diamonds are enhanced.

Mr_Orange

Senior Member

- Joined

- Jun 17, 2013

- Posts

- 5,841

I see lots of enhanced lips around. Are they better than natural lips?I think manufactured diamonds are enhanced.

Quickstatus

Enthusiast

- Joined

- Oct 13, 2013

- Posts

- 17,386

The problem is the what they are attached toAre they better than natural lips?

Quickstatus

Enthusiast

- Joined

- Oct 13, 2013

- Posts

- 17,386

Why no dividend in 2023?Finbar which is FR

Quickstatus

Enthusiast

- Joined

- Oct 13, 2013

- Posts

- 17,386

Yes I see they paid back the bank facility on the development early JulyMade up for it when project was completed.

- Joined

- Apr 14, 2013

- Posts

- 701

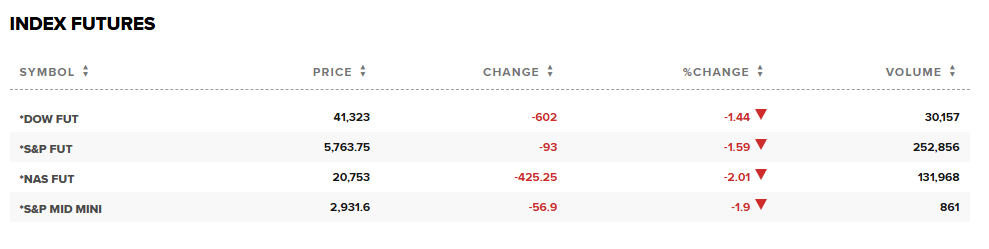

Could be the Harvard thing or 50% tariffs on EU or the tax reduction bill!Looks like Wall St is in for an interesting night -

View attachment 445174

RSD

Established Member

- Joined

- Feb 13, 2010

- Posts

- 3,158

- Qantas

- Platinum

EU 50% tariffs I would imagine.Could be the Harvard thing or 50% tariffs on EU or the tax reduction bill!

Last edited by a moderator:

SydneySwan

Established Member

- Joined

- Jan 12, 2014

- Posts

- 4,244

- Qantas

- LT Silver

- Virgin

- Red

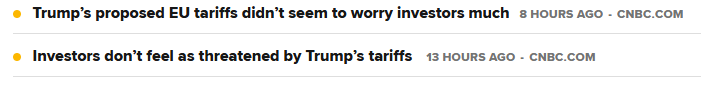

I was very surprised that the Dow and Nasdaq only had minor falls on Friday. I was expecting losses of at least 1k. I am wondering if Mr Market is beginning to take the tariff threats less seriously and a backflip as tariff deadlines approach.

The real problem for the US is the bond market. The US has lost its AAA rating with all 3 agencies. This will cost the US more in interest payments and also impact the ability / desire of some funds to buy so much US debt which presumably will push up US debt costs even more.

Australia could benefit here as it still has its AAA rating and may find its debt even more popular amongst debt funders. This may even save it a few basis points in cost.

The real problem for the US is the bond market. The US has lost its AAA rating with all 3 agencies. This will cost the US more in interest payments and also impact the ability / desire of some funds to buy so much US debt which presumably will push up US debt costs even more.

Australia could benefit here as it still has its AAA rating and may find its debt even more popular amongst debt funders. This may even save it a few basis points in cost.

On -ve watch. Just saying.Australia...still has its AAA rating

RSD

Established Member

- Joined

- Feb 13, 2010

- Posts

- 3,158

- Qantas

- Platinum

Two of the headlines from CNBC would suggest that the markets are taking the tariff threats a bit less seriously -I was very surprised that the Dow and Nasdaq only had minor falls on Friday. I was expecting losses of at least 1k. I am wondering if Mr Market is beginning to take the tariff threats less seriously and a backflip as tariff deadlines approach.

The real problem for the US is the bond market. The US has lost its AAA rating with all 3 agencies. This will cost the US more in interest payments and also impact the ability / desire of some funds to buy so much US debt which presumably will push up US debt costs even more.

Australia could benefit here as it still has its AAA rating and may find its debt even more popular amongst debt funders. This may even save it a few basis points in cost.

The 10 and 30 year yields have eased a bit - until the next bombshell anyway.

OPEC looks set to deliver one of his wish list items - lower oil prices.

Attachments

Last edited by a moderator:

I love to travel

Established Member

- Joined

- Jun 4, 2016

- Posts

- 3,397

- Qantas

- Silver Club

Any thoughts on La Trobe Launching ASX-listed Investment Fund, excerpt of info

The La Trobe Private Credit Fund brings together our two flagship, best-in-class strategies in the one convenient vehicle for investors. It will comprise a balanced and flexible exposure to:

The La Trobe Private Credit Fund brings together our two flagship, best-in-class strategies in the one convenient vehicle for investors. It will comprise a balanced and flexible exposure to:

- Australian Real Estate Private Credit through our 12 Month Term Account; and

- US Mid-Market Corporate Private Credit through our La Trobe US Private Credit Fund (Class A Units).

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- Brissy1

- Kc4334

- larry40

- craven morehead

- TomDrinkwater

- crosscheck

- Mrsfefe

- FlyingFiona

- ayebee

- Harrison_133

- cjd600

- MooTime

- jkbaus

- OzzRod

- Ko0l

- Growing Older

- Aeryn

- Willie

- Capricornus

- Pele

- Austman

- flyingfan

- Koosc

- Anastascia

- mviy

- Dnm92

- henleybeach

- butters_1313

- 306

- MELso

- gxia

- NTflyer

- kelvedon

- Chrizztofa

- KTA Return

- TheRealTMA

- bjhearne

- vyralmonkey

- Auzzieflyer

- downgraded

- Golf nut

- clifford

- sudoer

- http_x92

- blackcat20

- scottlu13

- Scr77

- Lat34

- Cms99

- MEL_Traveller

Total: 1,431 (members: 63, guests: 1,368)