Sure is one heck of a turnaround. Still has a long way to go I think, many things to cleanup and fix, however when was the last time they actually made real money? 10-15 years ago?

australianaviation.com.au

australianaviation.com.au

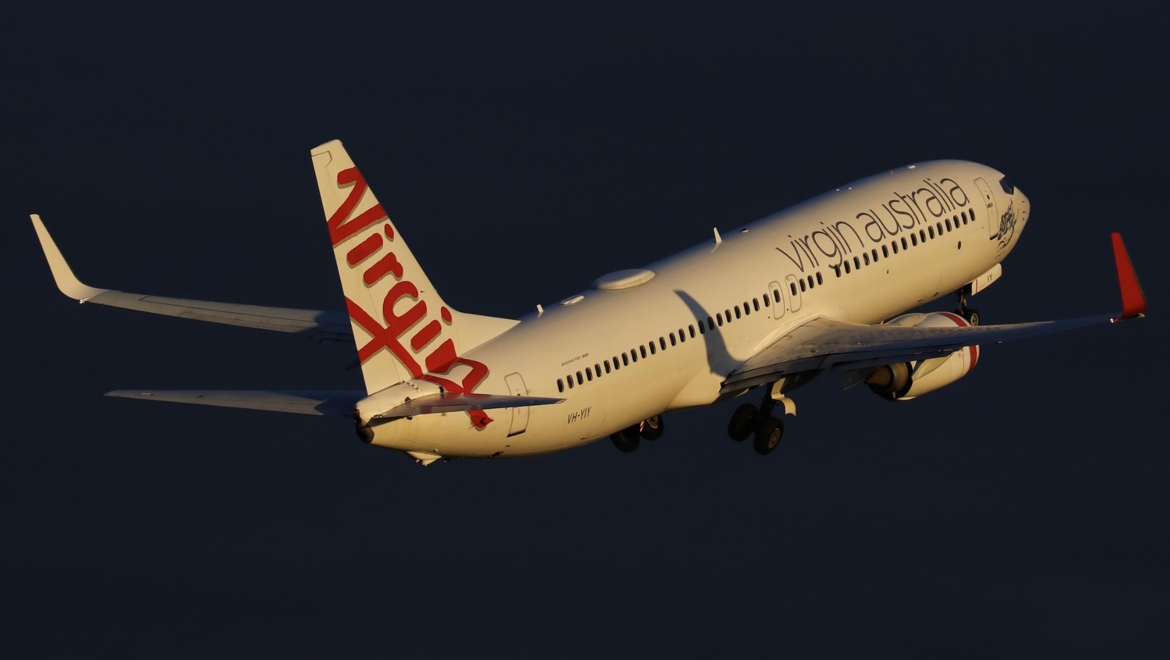

Virgin Australia could make IPO as early as next year: Jayne Hrdlicka says

Virgin Australia chief executive Jayne Hrdlicka says the airline has returned to profitability and is considering listing on the ASX as early as next year.

Tansy Harcourt

Jayne Hrdlicka talks to ground staff airside at Brisbane Airport on Thursday. ‘We’re punching above our weight.’ Picture: Lyndon Mechielsen

Virgin Australia chief executive Jayne Hrdlicka says the airline has returned to profitability and is considering listing on the ASX as early as next year.

...

Hrdlicka says Virgin doing ‘at least as well’ as Qantas

In an interview with The Australian, the CEO hailed the business’ “extraordinary” recovery and hinted it could be relisted on the ASX as soon as next year.

australianaviation.com.au

australianaviation.com.au

Last edited by a moderator: