PointsLife1

Member

- Joined

- Jan 30, 2020

- Posts

- 196

The information at the link below was quite helpful to me and includes a link to the IRS’ W7 form.

Individual Taxpayer Identification Number (ITIN) - Form W-7

An Individual Taxpayer Identification Number (ITIN) is assigned by the Internal Revenue Service to individuals involved in a transaction which may be aau.usembassy.gov

From re-reading the web page appears that the ITIN needs to be renewed every three years if not used to lodge a US tax return.

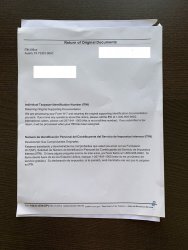

I Read somewhere it can take up to 7 weeks to get it back. I applied the last week of November. Might take longer because of the holidays. I’ve had a look on the form again doesn’t seem to ask for any reason. Mine if asked would be I intend to make investments in the US. Will post when I hear back. I notice (but haven’t used) there is a site EIN where it can be done electronically for a similar cost. I haven’t used that site so can’t give any feedback.

Keen to hear of others’ experiences in getting an ITIN if it took 7 weeks or longer and how well it’s worked.

@albyd

Any news on the ITIN number? With all this time home in ISO the mind seems to wonder over to the great Chase credit card applications.

How is everyone getting on with their US Amex cards and has anyone found a way to maximise or use the increased earn rates on US Supermarkets?

Luckily if not I assume we are all local champions and spending big amounts on our Platinum Edge cards locally.