You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

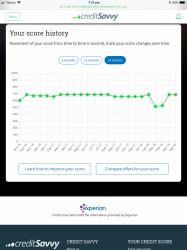

Sudden Death on Credit Savvy

- Thread starter Gold60

- Start date

- Status

- Not open for further replies.

rock86

Established Member

- Joined

- Jul 18, 2017

- Posts

- 1,179

My score is up again this month, it has been going up for the last few months. I went from 988 in March to 1045 in April.

Any credit card applications in there?

Any credit card applications in there?

No, my last credit card application was in early 2016, so I guess that's why it has been going up in the last few months.

Mr_Orange

Senior Member

- Joined

- Jun 17, 2013

- Posts

- 5,828

Seems the roulette wheel has spun again and I'm up another 67 points and that's in a month with an application.

Starting to claw back that 300 point loss from the start of the year.

Mine bounced straight back to where it had come from after 2 months and has now remained the same for 3 months. It was clearly a glitch when implementing the additional reporting.

Mine bounced straight back to where it had come from after 2 months and has now remained the same for 3 months. It was clearly a glitch when implementing the additional reporting.

Yeah no doubt. I was just a bit shocked when I heard all the instant recovery tales and mine basically stayed in the basement until last month.

aerotravel

Member

- Joined

- Apr 20, 2013

- Posts

- 124

Just got mine updated suddenly today... up by 86 points from Good to V. Good. Nice surprise there! been 2 years or so since...

get me outta here

Senior Member

- Joined

- Nov 18, 2011

- Posts

- 8,246

- Qantas

- LT Silver

I haven’t been able to log into Equifax for months and they are absolutely hopeless. They do keep sendimg emails telling me my score has changed. Is Credit Savy a reasonable alternative, or which others are there?

Credit Savvy gets you your Experian Score for free. GetCreditScore gets you your Equifax score for free. You may wish to get both. Experian and Equifax use different score ranges so the number you get will be different.I haven’t been able to log into Equifax for months... Is Credit Savy a reasonable alternative, or which others are there?

I love to travel

Established Member

- Joined

- Jun 4, 2016

- Posts

- 3,397

- Qantas

- Silver Club

Credit card score went up quite a bit today despite two applications in the last month. Go figure.

BTW does anyone know whether banks can see when you applied for credit cards or just see how many enquiries

BTW does anyone know whether banks can see when you applied for credit cards or just see how many enquiries

ragingsheep

Intern

- Joined

- Nov 9, 2015

- Posts

- 74

Citi now is reporting CCR, except on Credit Savvy, they are still reporting my card as open despite having closed it 2 months ago.

Yep, got a message from Credit Savvy today too, also the Qantas Premiere since Citibank run it. And because my repayment history is good my score went up.Citi now is reporting CCR, except on Credit Savvy, they are still reporting my card as open despite having closed it 2 months ago.

- Joined

- Jan 14, 2013

- Posts

- 6,594

- Qantas

- Qantas Club

- Virgin

- Red

- Oneworld

- Sapphire

- Star Alliance

- Silver

Mrs andye's Citi cards (VA Flyer closed, Coles open) showing on creditsavvy, both as open. Perfect repayment history put her score up by 9 points. Her HSBC has been on for some time

My Citi (VA Flyer) not showing yet

My Citi (VA Flyer) not showing yet

- Joined

- Jan 14, 2013

- Posts

- 6,594

- Qantas

- Qantas Club

- Virgin

- Red

- Oneworld

- Sapphire

- Star Alliance

- Silver

July has come round and my Equifax has jumped from 569 to 680 with no new activity  . I only have access via getcreditscore so don't know what CC info has been added.

. I only have access via getcreditscore so don't know what CC info has been added.

It did take a long time to get on the site when the email came around this evening-I guess everyone was seeing how reporting has gone

It did take a long time to get on the site when the email came around this evening-I guess everyone was seeing how reporting has gone

SeaWolf

Established Member

- Joined

- Jan 24, 2007

- Posts

- 1,726

- Qantas

- Bronze

- Virgin

- Platinum

- Star Alliance

- Gold

Anyone else used the Illion (Dun & Bradsheet) online tool (Credit Simple) to have a look at the info they've got stored away and discovered their credit score there is wildly different?

I signed up yesterday and even though Illion has exactly the same information as Experian, they've reached a much different opinion about my credit worthiness. Illion has given me a low 600 and says I'm ranked in the bottom 20% of my postcode. Experian has me on a mid-800 and says I'm in the top 25% of my postcode.

How on earth can they have exactly the same data but reach such radically different conclusions?

I signed up yesterday and even though Illion has exactly the same information as Experian, they've reached a much different opinion about my credit worthiness. Illion has given me a low 600 and says I'm ranked in the bottom 20% of my postcode. Experian has me on a mid-800 and says I'm in the top 25% of my postcode.

How on earth can they have exactly the same data but reach such radically different conclusions?

- Status

- Not open for further replies.

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- Milemuncher

- pauldab

- Foreigner

- Subharpoon

- jase05

- Scr77

- hydrabyss

- kpc

- flying_rac

- Austman

- jkbaus

- Jezzabell

- Peter D

- AIRwin

- ausfox

- SeatBackForward

- There'sOnlyOneJimmy

- Cms99

- Happy Dude

- PineappleSkip

- Noel Mugavin

- Harrison_133

- RooFlyer

- Flyfrequently

- craven morehead

- Oubline

- Nat

- flyingfan

- smiliemonster

- Askance

- frodo

- markis10

- offshore171

- stevenwr175

- Lochrockinbeats

- ozboy01

- cjd600

- bits

Total: 1,426 (members: 54, guests: 1,372)