You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

50000 Bonus Points for new eligible Car or Home Insurance

- Thread starter kamchatsky

- Start date

knightfall88

Member

- Joined

- May 3, 2016

- Posts

- 237

so the 40k offers expired 2nd July. How long does the application process take?

kamchatsky

Established Member

- Joined

- Mar 8, 2006

- Posts

- 4,028

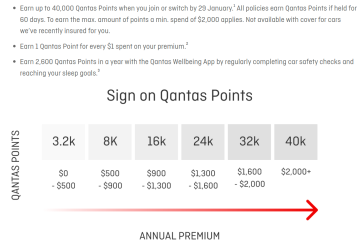

40000 points bonus is back for car and home insurance, promo ends on 29 January 2025:

exceladdict

Senior Member

- Joined

- Mar 26, 2014

- Posts

- 5,153

- Qantas

- Platinum

- Virgin

- Silver

I'm going to hold off a bit further, note this continues through January but I feel like it jumped to 50k for a few days late last year40000 points bonus is back for car and home insurance, promo ends on 29 January 2025:

lovestotravel

Senior Member

- Joined

- Sep 18, 2008

- Posts

- 7,557

I'll do both home and car for 40k each.. was hoping for an increase after the 30k offer ended

Looks like 2 Nov to 5 Dec last year was 50K

freepoints.com.au

freepoints.com.au

Looks like 2 Nov to 5 Dec last year was 50K

Up to 50,000 Qantas points when you take out a Qantas home or car insurance policy - FreePoints.com.au

Expired 5 Dec 2023

iamsuperandrew

Active Member

- Joined

- Mar 23, 2022

- Posts

- 872

- Qantas

- Qantas Club

- Virgin

- Gold

NOTE - Qantas Insurance has changed from 'have not held insurance with Qantas Insurance & partners in the past 6 months' to 12 months now

lovestotravel

Senior Member

- Joined

- Sep 18, 2008

- Posts

- 7,557

NOTE - Qantas Insurance has changed from 'have not held insurance with Qantas Insurance & partners in the past 6 months' to 12 months now

Yes it's sad

kamchatsky

Established Member

- Joined

- Mar 8, 2006

- Posts

- 4,028

kamchatsky

Established Member

- Joined

- Mar 8, 2006

- Posts

- 4,028

50000 points bonus for Car and Home insurance is back again! Need to sign up by 30 June 2025. It is part of Qantas points blitz campaign.

sevenfourtyseven

Member

- Joined

- Feb 23, 2017

- Posts

- 336

"Qantas Frequent Flyer members who purchase a Qantas Home Insurance policy between 29/05/2025 and 30/06/2025 with a min. annual premium of $2,000 will earn a maximum of 50,000 sign on Qantas Points over 6 months. Points will be awarded to the primary policyholder in two stages, based on the level of cover held at day 60: (1) up to 37,500 Qantas Points awarded for continuously holding a policy for 60 days and (2) up to 12,500 additional Qantas Points awarded for continuously holding a policy for 180 days. Points will ordinarily be awarded within 6 weeks of qualifying"

lovestotravel

Senior Member

- Joined

- Sep 18, 2008

- Posts

- 7,557

The 12 months prior rule change makes me sad

That being said I will do a car and health insurance application again.

That being said I will do a car and health insurance application again.

lovestotravel

Senior Member

- Joined

- Sep 18, 2008

- Posts

- 7,557

So can I use other family members to get home insurance at my home address, IE the same address but using the Wife's name ?

"Sign on Qantas Points are not available on homes or for contents that have been insured by the primary policyholder through Qantas Home Insurance at any time in the previous 12 months, unless for a different address. ""

"Sign on Qantas Points are not available on homes or for contents that have been insured by the primary policyholder through Qantas Home Insurance at any time in the previous 12 months, unless for a different address. ""

Mr H

Established Member

- Joined

- Dec 5, 2013

- Posts

- 3,479

I read it as meaning that if you move house and the previous owner had a Qantas policy at that address within the past year, it will not preclude you from also taking out a policy at that address and getting a sign up bonus. Equally, if you had a policy at your old address you can still get a sign up bonus for your new address even though the insured contents will be the same.So can I use other family members to get home insurance at my home address, IE the same address but using the Wife's name ?

"Sign on Qantas Points are not available on homes or for contents that have been insured by the primary policyholder through Qantas Home Insurance at any time in the previous 12 months, unless for a different address. ""

kamchatsky

Established Member

- Joined

- Mar 8, 2006

- Posts

- 4,028

50000 bonus points offer is back, but only up to 30 October.

insurance.qantas.com

insurance.qantas.com

Qantas Frequent Flyer (QFF) members who purchase a Qantas Car Insurance policy between 21/10/2025 and 11:59pm (AET) 30/10/2025, will earn up to 50,000 Qantas Points over 6 months. Points will be awarded to the primary policyholder in two stages, based on the level of cover held at day 60: (1) up to 37,500 Qantas Points awarded for continuously holding a policy for 60 days and (2) up to 12,500 additional Qantas Points awarded for continuously holding a policy for 180 days. Points will ordinarily be awarded within 6 weeks of qualifying. Find out how your annual premium determines the amount of Qantas Points you'll earn per policy here. Sign on Qantas Points are not available for any insurance policy purchased for a vehicle that has been insured by the primary policyholder through Qantas Car Insurance at any time in the 12 months prior to policy purchase date. Qantas may withdraw or extend this offer at any time.

For 10 days only, earn up to 270,000 points across health, travel, car and home

But you better be quick, offer ends 30 October.Qantas Insurance

Qantas Insurance is the only health and travel insurance company offering a wellbeing program that rewards you for being active. Find out more today.

Car Insurance

Earn up to 50,000PTS when you join by 30 October.3 All policies earn points, based on your premium over 6 months. To earn 50,000 points, a min. annual premium of $2,000 applies. Not available with cover for cars we've recently insured for you.Home Insurance

Earn up to 50,000PTS when you join by 30 October.4All policies earn points, based on your premium over 6 months. To earn 50,000 points, a min. annual premium of $2,000 applies. Not available with cover for homes or contents we've recently insured for you.Travel Insurance

Earn up to 20,000PTS for taking out a policy by 30 October.2 All policies earn Qantas Points. To earn the maximum amount of points a min. spend of $1,000 applies.Health Insurance

Earn up to 150,000PTS for joining or switching by 30 October.1 Points will be awarded based on your level of cover over 6 months. Not available if you’ve recently held health insurance issued by nib.Qantas Frequent Flyer (QFF) members who purchase a Qantas Car Insurance policy between 21/10/2025 and 11:59pm (AET) 30/10/2025, will earn up to 50,000 Qantas Points over 6 months. Points will be awarded to the primary policyholder in two stages, based on the level of cover held at day 60: (1) up to 37,500 Qantas Points awarded for continuously holding a policy for 60 days and (2) up to 12,500 additional Qantas Points awarded for continuously holding a policy for 180 days. Points will ordinarily be awarded within 6 weeks of qualifying. Find out how your annual premium determines the amount of Qantas Points you'll earn per policy here. Sign on Qantas Points are not available for any insurance policy purchased for a vehicle that has been insured by the primary policyholder through Qantas Car Insurance at any time in the 12 months prior to policy purchase date. Qantas may withdraw or extend this offer at any time.

Read our AFF credit card guides and start earning more points now.

AFF Supporters can remove this and all advertisements

The notion of paying $2k for 50k is ludicrous for home or car insurance. You could get double that through wine… and that’s not even considering if the policy is even any good.

You’re not paying $2k. Presumably you already have comparable car insurance that you are going to switch from. The actual cost of the 50,000pts is the difference in cost between the two policies.

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- smiliemonster

- OZDUCK

- MELso

- VPS

- bam71

- Rebus

- SydneySwan

- Lukerayment

- mviy

- Up in the clouds

- muppet

- pangwen

- moa999

- bluecoconut

- SYD

- Greenline

- Willie

- antycbr

- dajop

- rcg

- clifford

- kiwipino

- ShrinkWrapped

- ausfox

- turtlemichael

- marquisite

- tassiemark

- Darkpulsar

- pjm99au

- http_x92

- Dsaykao

- Big John

- NickJL

- JohnM

- cjd600

- jase05

- tassie6

- paddywide

- RnD

- WrenchHammerMcTool

- wentworthmeister

- Zinger

- dizzie131

- jeza

- LionKing

- Franky

- _TheTraveller_

- Sbv72

- pico99

- frodo

Total: 2,416 (members: 72, guests: 2,344)