You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Scams like these

- Thread starter Foreigner

- Start date

I just got the exact same emailI wished I could have issued Letters of Demand, Infringement Notices etc "To Whom It May Concern" back in my Customs life. It would have all been so much easier.

- Joined

- Apr 4, 2024

- Posts

- 548

- Qantas

- Silver Club

- Virgin

- Red

- Oneworld

- Ruby

Welcome to posting on AFF @casey18I just got the exact same email

AustraliaPoochie

Senior Member

- Joined

- Feb 9, 2014

- Posts

- 8,140

Do a reverse image search, just as a tinr waster.

See who the real girl is, / how m any inages of her around.

VPS

Enthusiast

- Joined

- Apr 2, 2011

- Posts

- 10,543

- Qantas

- LT Gold

- Virgin

- Gold

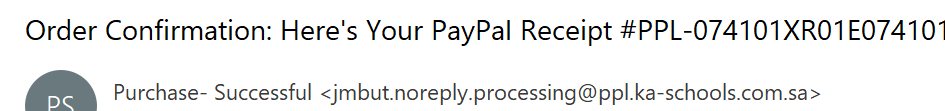

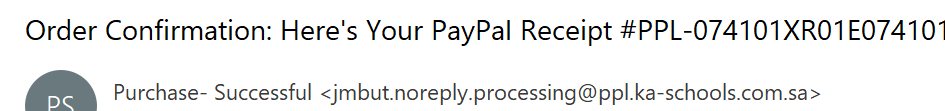

Sent to me and 500 others

Dear Customer,

Good news! We've successfully processed your payment of $266.99 AUD for your recent order.

Payment Details:

Amount: $266.99 AUD

Transaction ID: PPL-074101XR01E074101

Date: Wednesday, 25 June 2025

If anything about this transaction looks unfamiliar, or if you have any questions, please call us immediately at 1800 958 374.

Please don't reply to this email. For all inquiries, use the phone number provided.

Thanks for your business!

Dear Customer,

Good news! We've successfully processed your payment of $266.99 AUD for your recent order.

Payment Details:

Amount: $266.99 AUD

Transaction ID: PPL-074101XR01E074101

Date: Wednesday, 25 June 2025

If anything about this transaction looks unfamiliar, or if you have any questions, please call us immediately at 1800 958 374.

Please don't reply to this email. For all inquiries, use the phone number provided.

Thanks for your business!

MonteCristo

Intern

- Joined

- Apr 7, 2023

- Posts

- 78

- Qantas

- Silver

My Citi credit card got skimmed somehow, somewhere, in Greece.

Had only used it online for travel purchases before going to Greece (ferry tickets, and a couple of Viator day tours), and for a couple of domestic direct debits. Then I took it to Greece, and only used it at supermarkets, some official attractions (old historic stuff), and petrol stations.

A few weeks into the trip - within 5 minutes I get a couple of SMSes with codes for $1300 transactions while I'm on a hike (said it was from the same vendor - some European energy company, apparently), followed by a $10 Zara online transaction that got automatically blocked by Citi - who pulled the plug on the card.

No damage done - none of the transactions went through thankfully. But still, could you believe there's someone shonky in Athens or Crete?

Had only used it online for travel purchases before going to Greece (ferry tickets, and a couple of Viator day tours), and for a couple of domestic direct debits. Then I took it to Greece, and only used it at supermarkets, some official attractions (old historic stuff), and petrol stations.

A few weeks into the trip - within 5 minutes I get a couple of SMSes with codes for $1300 transactions while I'm on a hike (said it was from the same vendor - some European energy company, apparently), followed by a $10 Zara online transaction that got automatically blocked by Citi - who pulled the plug on the card.

No damage done - none of the transactions went through thankfully. But still, could you believe there's someone shonky in Athens or Crete?

AustraliaPoochie

Senior Member

- Joined

- Feb 9, 2014

- Posts

- 8,140

Its a real shocking thing, (sad too in a way), that the banks, and also world govts in way, are pushing cashless, but then, all these scams and frauds are linked to card use.

In Aus, I used my card at vending machines, and at petrol stations, and Coles, Woolworths, etc, and yes, paypal etc too, and yep, it got misused.

Never used ubereats, or Doordash, and I got pinged for $25.88, reported it to my bank, they reversed the transaction, this was visa debit, they reversed the transaction, but of course, they dont track or give info on where the transaction occured.

Card cancelled and changed, but now, no more vendo purchases.

Back to cash, but then, vendos now do not accept cash, and also, its a disincentive to use cards, seeing so much/many scams/card frauds.

The bank lady also said, it would be hard to exactly pinpoint the place where the store/vendo or merchants system got a card reader placed on it.

Chip card no less, grr, not a happy pooch.

In Aus, I used my card at vending machines, and at petrol stations, and Coles, Woolworths, etc, and yes, paypal etc too, and yep, it got misused.

Never used ubereats, or Doordash, and I got pinged for $25.88, reported it to my bank, they reversed the transaction, this was visa debit, they reversed the transaction, but of course, they dont track or give info on where the transaction occured.

Card cancelled and changed, but now, no more vendo purchases.

Back to cash, but then, vendos now do not accept cash, and also, its a disincentive to use cards, seeing so much/many scams/card frauds.

The bank lady also said, it would be hard to exactly pinpoint the place where the store/vendo or merchants system got a card reader placed on it.

Chip card no less, grr, not a happy pooch.

prozac

Senior Member

- Joined

- Jan 7, 2010

- Posts

- 6,161

My Citi credit card got skimmed somehow, somewhere, in Greece.

Had only used it online for travel purchases before going to Greece (ferry tickets, and a couple of Viator day tours), and for a couple of domestic direct debits. Then I took it to Greece, and only used it at supermarkets, some official attractions (old historic stuff), and petrol stations.

A few weeks into the trip - within 5 minutes I get a couple of SMSes with codes for $1300 transactions while I'm on a hike (said it was from the same vendor - some European energy company, apparently), followed by a $10 Zara online transaction that got automatically blocked by Citi - who pulled the plug on the card.

No damage done - none of the transactions went through thankfully. But still, could you believe there's someone shonky in Athens or Crete?

Could your card details have been harvested by someone brushing past you? I keep seeing ads for RFID-blocking travel wallets. Can anyone vouch the efficacy of these?

- Joined

- Jun 24, 2008

- Posts

- 4,723

- Qantas

- Gold

- Virgin

- Red

Certainly can: a few years ago my preferred debit card for overseas spend got cleaned out. The only place I had used it in the previous 12+ months was to purchase flights online with Aegean Airlines.But still, could you believe there's someone shonky in Athens or Crete?

A new one for me...

Trying to sell a secondhand car on Facebook Marketplace.

Get the usual...Is this Available...Stifle the urge for a smartass comeback and type Yes

Name is a female name, profile pic is a happy white family

Her next reply - We will meet tomorrow so I can view the vehicle and discuss price

Just like that as an ORDER, not asking if its OK etc first

Me - Price is in the ad, we can meet but. (ad had only been up for a couple hours)

Her - Ok I will pay your price...do you have a CSC?

Me - What is CSC?

Her - Sends link, looks like a Car History report type thing.

Me - I dont need that to sell, I have Safety Certificate and Rego, thats all I need.

Her - Goes on a rant about how it is SELLERS legal responsibility to have one

Me - No, you get it if you want it.

End of discussion, I was thinking gee what a cough etc.

Next Day another message, exact same script but different womans name and profile

I think that is not right, getting two the same nearly word for word and google.

Apparently some people DO pay $50 - $100 dollars for this bogus certificate to sell the car at their price...so they are out the money, get stuffed around at a meeting with a no show and still dont sell their car.

Note - rules where you live may be different and these types of certificates are a real thing but there is usually a government site that does it for a minimal fee like $10 or something.

Trying to sell a secondhand car on Facebook Marketplace.

Get the usual...Is this Available...Stifle the urge for a smartass comeback and type Yes

Name is a female name, profile pic is a happy white family

Her next reply - We will meet tomorrow so I can view the vehicle and discuss price

Just like that as an ORDER, not asking if its OK etc first

Me - Price is in the ad, we can meet but. (ad had only been up for a couple hours)

Her - Ok I will pay your price...do you have a CSC?

Me - What is CSC?

Her - Sends link, looks like a Car History report type thing.

Me - I dont need that to sell, I have Safety Certificate and Rego, thats all I need.

Her - Goes on a rant about how it is SELLERS legal responsibility to have one

Me - No, you get it if you want it.

End of discussion, I was thinking gee what a cough etc.

Next Day another message, exact same script but different womans name and profile

I think that is not right, getting two the same nearly word for word and google.

Apparently some people DO pay $50 - $100 dollars for this bogus certificate to sell the car at their price...so they are out the money, get stuffed around at a meeting with a no show and still dont sell their car.

Note - rules where you live may be different and these types of certificates are a real thing but there is usually a government site that does it for a minimal fee like $10 or something.

MonteCristo

Intern

- Joined

- Apr 7, 2023

- Posts

- 78

- Qantas

- Silver

It's possible. That said, while in Greece I've used two credit cards. I used the Citi to reach an overseas spend offer that they had for about 2 weeks. While I was using it, it was otherwise in my regular wallet. But the other times I used the other card, it was kept in an RFID-blocking waist holder together with passports and some spare cash. So... *shrug*Could your card details have been harvested by someone brushing past you? I keep seeing ads for RFID-blocking travel wallets. Can anyone vouch the efficacy of these?

prozac

Senior Member

- Joined

- Jan 7, 2010

- Posts

- 6,161

Don't know what to make of this SMS except to say I don't think it is a scam but I'll be f@*7ed if I am going to provide any of this information to Westpac.

EDIT: Irrespective of this not being a scam I have forwarded the message to ACMA (0429 999 888) who hopefully will give Westpac a rocket when enough people report.

Hi Prozac, to keep your account safe, we need you to verify your ID, update your employment and income details, and update your contact details. It's important to confirm your details by 25 July 2025.

To complete the process, you can either:

1. Sign into the Westpac App or Online Banking via Mobile, type "Verify ID" in the search bar, select "Verify your ID" and verify your personal information. Or;

2. Sign into Online Banking via Desktop, Select "Service", then under "Your Preferences" select "Verify your ID" and verify your personal information.

For more details, visit westpac.com.au and search "ID Secure" or call us on 1300 360 766. If you've already actioned this request, please ignore this message.

Your Westpac team

EDIT: Irrespective of this not being a scam I have forwarded the message to ACMA (0429 999 888) who hopefully will give Westpac a rocket when enough people report.

Last edited:

- Joined

- Jul 8, 2007

- Posts

- 2,877

- Qantas

- Platinum 1

- Virgin

- Red

- Oneworld

- Emerald

Thought it was a legal requirement for banks to periodically perform a KYC check these days?Don't know what to make of this SMS except to say I don't think it is a scam but I'll be f@*7ed if I am going to provide any of this information to Westpac.

- Joined

- Apr 4, 2024

- Posts

- 548

- Qantas

- Silver Club

- Virgin

- Red

- Oneworld

- Ruby

Agree @DejaBrewThought it was a legal requirement for banks to periodically perform a KYC check these days?

I get KYC requests from CBA every 2 years

Read our AFF credit card guides and start earning more points now.

AFF Supporters can remove this and all advertisements

CMA222

Active Member

- Joined

- Oct 15, 2009

- Posts

- 998

It is genuine and they just keep sending the request until you reply. The process is all done online (via the website or App of the bank - no links to worry about) until it does not work, when they say "Sorry please go to a branch". I queried them when I wasted my time going to a branch and they said it is "a government requirement" so the bank can monitor unusual cash and asset acquisition activity. If you do not respond they eventually say they will suspend all you account access until you respond. A tick the box exercise for the banks.Don't know what to make of this SMS except to say I don't think it is a scam but I'll be f@*7ed if I am going to provide any of this information to Westpac.

lovestotravel

Senior Member

- Joined

- Sep 18, 2008

- Posts

- 7,517

Don't know what to make of this SMS except to say I don't think it is a scam but I'll be f@*7ed if I am going to provide any of this information to Westpac.

EDIT: Irrespective of this not being a scam I have forwarded the message to ACMA (0429 999 888) who hopefully will give Westpac a rocket when enough people report.

It's not a scam... and why would it be when it clearly tells you to go directly to Westpac online services and complete the steps.

If you don't do it in the next 30/60/90 days expect your accounts to be locked in some way

IE: Deposits only, or view only or totally unable to be viewed from your online banking

lovestotravel

Senior Member

- Joined

- Sep 18, 2008

- Posts

- 7,517

It is genuine and they just keep sending the request until you reply. The process is all done online (via the website or App of the bank - no links to worry about) until it does not work, when they say "Sorry please go to a branch". I queried them when I wasted my time going to a branch and they said it is "a government requirement" so the bank can monitor unusual cash and asset acquisition activity. If you do not respond they eventually say they will suspend all you account access until you respond. A tick the box exercise for the banks.

I refused to go into the bank for one of my kids accounts. It was activated without requesting for a birth certificate/passport etc, and was fine for about 10 years. They are still a minor.

Suddenly, account unable to be viewed online, no warning.

Rang them and first person had no idea

Lodged an complaint, got $1000 compo and an apology, and yes locked due to KYC.. Said the only way it will get unlocked is by going into a branch. They will not accept any other way of verifying the birth certificate.

Sadly, I ended up doing it, as any bank can close your account for any reason at any time...

prozac

Senior Member

- Joined

- Jan 7, 2010

- Posts

- 6,161

I have a business banker who knows my banking affairs intimately. They still should not be asking customers to accept messages to their phones asking customer to follow link or phone a particular phone number and asking for personal and income information. This is everything experts tell you not to do, respond to links and phone numbers in phone messages. I'll be saving the SMS and email as evidence for the lawyers in-case I ever get scammed and Westpac refuse to re-imburse me.It is genuine and they just keep sending the request until you reply. The process is all done online (via the website or App of the bank - no links to worry about) until it does not work, when they say "Sorry please go to a branch". I queried them when I wasted my time going to a branch and they said it is "a government requirement" so the bank can monitor unusual cash and asset acquisition activity. If you do not respond they eventually say they will suspend all you account access until you respond. A tick the box exercise for the banks.

AustraliaPoochie

Senior Member

- Joined

- Feb 9, 2014

- Posts

- 8,140

There is something more indepth than KYC, its the AML/CTF reporting, is this the same as KYC?

lovestotravel

Senior Member

- Joined

- Sep 18, 2008

- Posts

- 7,517

There is something more indepth than KYC, its the AML/CTF reporting, is this the same as KYC?

Kind of of, banks hide/use both of them when they need to tick a box or two

Become an AFF member!

Join Australian Frequent Flyer (AFF) for free and unlock insider tips, exclusive deals, and global meetups with 65,000+ frequent flyers.AFF members can also access our Frequent Flyer Training courses, and upgrade to Fast-track your way to expert traveller status and unlock even more exclusive discounts!

AFF forum abbreviations

Wondering about Y, J or any of the other abbreviations used on our forum?Check out our guide to common AFF acronyms & abbreviations.

Currently Active Users

- mcbling

- jabba

- Noah Count

- I love to travel

- tassie6

- Lukerayment

- diamondhands

- vhojm

- Doug_Westcott

- dajop

- aspro2

- sihyonkim

- Dmac59

- SJF211

- drron

- anat0l

- humley123

- tgh

- IW

- Hawk529

- snooze

- KTA Return

- Grrr

- moa999

- SYD

- Bighead

- defurax

- Fruit1008

- utaussiefan

- andiye

- MEL_Traveller

- kamchatsky

- EmBee

- DC-Treks

- stevenwr175

- axkhanna1

- Pete98765432

- StayGoldPonyboy

- Leo123

- kpc

- Rich

- Cottman

- justinbrett

- nubbie

- TMP

- FlyingFiona

- Kristian

- Traveller X

- Oscarq

- BodohBordeaux

Total: 842 (members: 74, guests: 768)