lovestotravel

Senior Member

- Joined

- Sep 18, 2008

- Posts

- 6,720

Well I'm off to Fiji in a few weeks, but not many ATM's to use there, so will just take a wad of small notes for the villages and small purchases

Yes, we used credit card for most things (also Mastercard), but we found some things still needed cash and we didn't have a lot of USD.BUT, Argentina's central bank in November 2022 launched a preferential exchange rate for foreign tourists (ie using foreign credit card). Payments made by Mastercard (our direct experience) now use the MEP ("electronic payment market") dollar exchange rate (the "blue" rate) BUT (again) the "foreign tourist dollar" only works for purchases, not ATM withdrawals so far.

Most of our South American adventures (Antarctica cruise, Chile, Brazil, Argentina) were pre-paid including organised tours/ sightseeing/ events etc so for us it was mostly cash for tip money and everyone loved USD (especially Argentina). Over four days in Buenos Aires we spent ~A$92 nett on the card (159-67cr). With no foreign exchange fees and the convenience factor, we like 28 Degrees but agree CC payment is not the absolute best you can do.Yes, we used credit card for most things (also Mastercard), but we found some things still needed cash and we didn't have a lot of USD.

It should be noted the credit card rate is not as good as getting cash. For comparison, if changing USD to pesos the rates were the best - but you also need to work in the AUD/USD exchange rate and the hassle of getting USD if you are not from or had been there. Western Union gave us around 250pesos/AUD, Mastercard was around 230pesos/AUD. Official rate was around 130pesos/AUD.

It was a huge relief to only need a little cash though, and not pay everything with cash, which is what we were expecting at the beginning of the trip. Even though the changes were announced in Nov, Visa/Mastercard only had it in place at the end of January, and last I heard, Amex is "still working on it"

Like I said. Some countries want cash only. Egypt and Israel. Additionally at Christmas time the Christmas market holders want cash. Not a card. Not all of the world has gone cashless.Cash ? Spent 9 weeks in Europe, had cash with me before I left, and come home with 75% of it

Egypt, Israel and Jordan have been on our bucket list for decades. Finally getting there in a couple of weeks.Yes and likely other places I also have no intention of visiting in the foreseeable future.

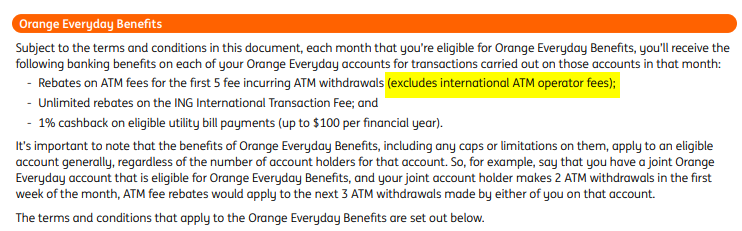

Don’t have a Citi card (not necessary with ING - well for now). Using any ATM fee free is a unique perk of ING. It will be a shame if it’s “enhanced”.

I'm heading to HK and the UK soon

You likely wont need any cash in HK or UK; but if you do most ATMs in the UK are fee free.

Ive not come across any store/resturant in the UK since 2018 which is cash only.

If the rumour is true, then at least you'll likely to be able to make use of the card before any "enhancement".Egypt, Israel and Jordan have been on our bucket list for decades. Finally getting there in a couple of weeks.

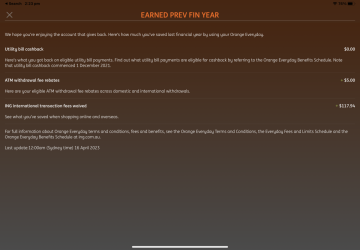

I'm going to take a screenshot of the confirmation that I've qualified ror the five free ATM withdrawals for both April and May and cash deposit.If the rumour is true, then at least you'll likely to be able to make use of the caes before any "enhancement".

The rumour was about foreign ATM withdrawals. Beyond that, who knows…Are they getting rid of the other international rebate too? That would hit me.

Unlimited electronic transactions including access to ATMs with no service charge from HSBC in Australia and across the HSBC Group ATMs except in Argentina, France, Greece, Mexico, Malta and Turkey.I'm heading to HK and the UK soon and have confirmed that there are HSBC ATMs where I'm going, I'm thinking my Australian Everday Global HSBC account will be ATM fee free (although it seems that most UK ATMs are fee-free?)

(Page 37 of https://www.hsbc.com.au/content/dam.../transaction-savings-terms-and-conditions.pdf )

Still no comparison to ING and the only thing having to worry about is keeping it under 5 withdrawals/month.

It may be worth grabbing a Citibank Plus card before they stop offering them 20 May 2023 if the fee-free Citibank ATM inclusion is worth something to you if ING does end up scrapping theirs. (Citibank Plus Everyday Account - Citi Australia)

You clearly don't eat at the places I do in HKYou likely wont need any cash in HK

I didn't need a lot of cash in the UK but a lot of parking places in smaller towns only took cash and some small bus routes as well.Great - thanks for the feedback. I know I will need cash in the UK as it will be a longer stay and it's a particular circumstance but think I may just open a bank account over there (I'm eligible) rather than rely on ING/Citi maintaining a feature of their products given the "product enhancements" that NAB will most likely bring in after they continue to merge Citi into their infrastructure.

Most ATM are fee free but you do need to keep an eye out but they are pretty good and telling you that you will get a fee if you proceedI'm heading to HK and the UK soon and have confirmed that there are HSBC ATMs where I'm going, I'm thinking my Australian Everday Global HSBC account will be ATM fee free (although it seems that most UK ATMs are fee-free?)

Struggling to use your Frequent Flyer Points?

Frequent Flyer Concierge takes the hard work out of finding award availability and redeeming your frequent flyer or credit card points for flights.

Using their expert knowledge and specialised tools, the Frequent Flyer Concierge team at Frequent Flyer Concierge will help you book a great trip that maximises the value for your points.

Well that's disappointing...they have no competitor for this benefit of refunding ATM fees, so i guess they feel they can end the benefit. Well after 1 August, I might have to dust off my Citibank card againNow confirmed starting 1 August 2023.

Orange Everyday Benefits

Fees and Limits

I don’t see much point in keeping this account after August.

Sample AFF with no advertisements? More..

Sample AFF with no advertisements? More..