- Joined

- Oct 14, 2012

- Posts

- 31

- Qantas

- Platinum

- Virgin

- Red

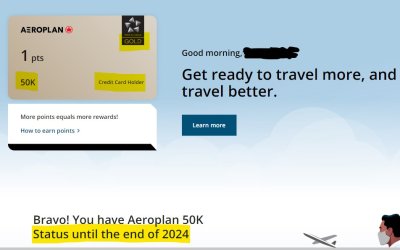

Looks like SQ didn't read their Ts&Cs properly. Let us know if they honour the Ts&Cs please. It's kinda in black & white, hard for them to argue against.Hi there, I received an email on 30th Dec from star alliance confirming that I was eligible for gold status based on the HSBC credit card promotion. I followed the link in the email to select Singapore airline as my status airline. I got a call today from Singapore airline to tell me that my Gold Status will not be upgraded to Gold until the 12 month anniversary of the Credit Card opening. I then looked up the T&Cs and see in the FAQs attached that as part of the welcome offer, status upgrade would be in 10 days. Did anyone else have this problem or can anyone give me some help please? Thanks everyone!