surely this might be one of the worst value credit cards on offer in Australia. No benefits and $6pm fee. There is so many others out there for no fee.I have applied for the low rate card with a limit of $6k

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Card Promotions Commonwealth Bank (Ultimate Awards Card) 100K award points – potentially fee free

- Thread starter Dr Ralph

- Start date

Struggling to use your Frequent Flyer Points?

Frequent Flyer Concierge takes the hard work out of finding award availability and redeeming your frequent flyer or credit card points for flights.

Using their expert knowledge and specialised tools, the Frequent Flyer Concierge team at Frequent Flyer Concierge will help you book a great trip that maximises the value for your points.

surely this might be one of the worst value credit cards on offer in Australia. No benefits and $6pm fee. There is so many others out there for no fee.

Agree on the lack of benefits, potentially no fees are payable if the account holder has a wealth package with CBA per page 4 of the link above?

MELso

Active Member

- Joined

- Nov 12, 2011

- Posts

- 625

- Qantas

- Bronze

- Virgin

- Red

Although why wouldn't you go for an Ultimate (or at least Smart) Awards card if you have a wealth package?

Agree on the lack of benefits, potentially no fees are payable if the account holder has a wealth package with CBA per page 4 of the link above?

I can't answer with any certainty, personally I just recently applied for the ultimate card myself, perhaps the benefits associated with the low card rate suit the other poster's needs? The current offer on that card is "Enjoy 0% p.a. on purchases for 12 months + $250 cashback when you apply by 30 September 2023 and spend $1,000 within the first 90 days. Conditions apply", if I had to guess maybe the interest savings outweight the points benefits the post can derive from this card over other cards?Although why wouldn't you go for an Ultimate (or at least Smart) Awards card if you have a wealth package?

exceladdict

Established Member

- Joined

- Mar 26, 2014

- Posts

- 4,632

- Qantas

- Platinum

- Virgin

- Silver

Do the 70k bonus points show up anywhere on the CBA online awards portal prior to crediting to QFF? ANZ has a specific line item for bonus points but I'm not sure where to look for CBA.

Also interested to know as I'm certain I've spent >$6k and have just received my 2nd statement but no 70k Qantas points, only the base points. Hoping to cancel the card before my 3rd statement to avoid the $35 monthly fee.Do the 70k bonus points show up anywhere on the CBA online awards portal prior to crediting to QFF? ANZ has a specific line item for bonus points but I'm not sure where to look for CBA.

exceladdict

Established Member

- Joined

- Mar 26, 2014

- Posts

- 4,632

- Qantas

- Platinum

- Virgin

- Silver

I'm going to miss PCP if these don't credit in time. I also found it odd that the first statement generated only two weeks into having the card open, rather than a full month from opening date as I expected.Also interested to know as I'm certain I've spent >$6k and have just received my 2nd statement but no 70k Qantas points, only the base points. Hoping to cancel the card before my 3rd statement to avoid the $35 monthly fee.

If I understood correctly, others have commented that after hitting the spend they had the bonus points credit in the next statement (eg. end of the month in which they hit the criteria) so I hope that comes true for me.

Otherwise will try to change the statement date to have two rounds of points credit during september.

Very late reply to this post, but today is 25th August, and I have still had no communication from CBA for my existing Ultimate that I have had for about four years I think telling me that the spend to avoid the $35 per month fee is increasing.Given that August is only next month and I've had no communication from CBA, is there a chance that this 4k minimum spend rule doesn't apply to existing customers, or is that just wishful thinking?

I guess they have up until 11:59pm tonight to notify me of the changes, but it's looking like - at least for the moment, that I'm still on the $2,500 per month figure for avoiding the $35 per month fee.

I think I've paid it twice since holding the card - once when I mucked up my calculations about timing of a direct debit, and once when I had a large refund processed to the card just before the statement calculation that took be below the limit.

As an aside, I also earned nearly 27,000 awards points in August:

- Ultimate International - 3 points per $1: +18961 points

- Ultimate Major stores, petrol, dining & utilities - 2 points per $1: +3738 points

- Ultimate Everywhere else - 1 point per $1: +2815 points

- Ultimate Spend over $10K - 0.5 points per $1: +1123 points

I found it odd too that my first statement period wasn't for a full month, lucky I had spent >$2.5k by the time.I'm going to miss PCP if these don't credit in time. I also found it odd that the first statement generated only two weeks into having the card open, rather than a full month from opening date as I expected.

If I understood correctly, others have commented that after hitting the spend they had the bonus points credit in the next statement (eg. end of the month in which they hit the criteria) so I hope that comes true for me.

Otherwise will try to change the statement date to have two rounds of points credit during september.

How do you change the statement date?

exceladdict

Established Member

- Joined

- Mar 26, 2014

- Posts

- 4,632

- Qantas

- Platinum

- Virgin

- Silver

I am hoping ill be able to do so over the phone, and that it will also change the date that points sweep. but i know thats not possible with some banks who sweep to qf on or around the same day each monthI found it odd too that my first statement period wasn't for a full month, lucky I had spent >$2.5k by the time.

How do you change the statement date?

MELso

Active Member

- Joined

- Nov 12, 2011

- Posts

- 625

- Qantas

- Bronze

- Virgin

- Red

I’m also hoping to get my 70K points soon (plus 15K Finder bonus).

Got my card on 16/8, met minimum spend ($6K) on 21/8, statement on 23/8, and base points arrived 24/8. As my membership year ends on 31 October, I have a little while before I need to panic over PC qualification (now 91.8K away), but it’d be nice to bank the points and close the card before the next statement day around 23 September (and the monthly fee that would entail)…

Got my card on 16/8, met minimum spend ($6K) on 21/8, statement on 23/8, and base points arrived 24/8. As my membership year ends on 31 October, I have a little while before I need to panic over PC qualification (now 91.8K away), but it’d be nice to bank the points and close the card before the next statement day around 23 September (and the monthly fee that would entail)…

exceladdict

Established Member

- Joined

- Mar 26, 2014

- Posts

- 4,632

- Qantas

- Platinum

- Virgin

- Silver

This gives me confidence that statements can be at any time of the month, as mine is in the first few days of the month. Very weird pattern though to start with a half monthI’m also hoping to get my 70K points soon (plus 15K Finder bonus).

Got my card on 16/8, met minimum spend ($6K) on 21/8, statement on 23/8, and base points arrived 24/8. As my membership year ends on 31 October, I have a little while before I need to panic over PC qualification (now 91.8K away), but it’d be nice to bank the points and close the card before the next statement day around 23 September (and the monthly fee that would entail)…

exceladdict

Established Member

- Joined

- Mar 26, 2014

- Posts

- 4,632

- Qantas

- Platinum

- Virgin

- Silver

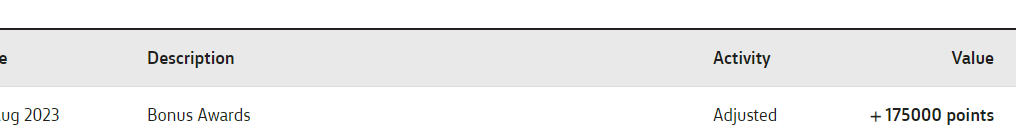

Confirming that points have appeared as a transaction during the second statement period, after I hit the spend a week or two prior, but also in the second statement period due to the weirdly shorter first statement period.This gives me confidence that statements can be at any time of the month, as mine is in the first few days of the month. Very weird pattern though to start with a half month

Hoping this means they'll sweep to my account in a week or so when second statement is issued.

MELso

Active Member

- Joined

- Nov 12, 2011

- Posts

- 625

- Qantas

- Bronze

- Virgin

- Red

Mine have also been awarded today. They'll probably sweep with my second statement.

(My 15K points from the Finder promo lobbed in a couple of days ago.)

Now just got to find the cheapest way of getting the remaining 6.2K points to qualify for PC. Will probably just buy some more wine...

(My 15K points from the Finder promo lobbed in a couple of days ago.)

Now just got to find the cheapest way of getting the remaining 6.2K points to qualify for PC. Will probably just buy some more wine...

exceladdict

Established Member

- Joined

- Mar 26, 2014

- Posts

- 4,632

- Qantas

- Platinum

- Virgin

- Silver

Nice. Hopefully a good Woolworths gift card offer comes through for you!Mine have also been awarded today. They'll probably sweep with my second statement.

(My 15K points from the Finder promo lobbed in a couple of days ago.)

Now just got to find the cheapest way of getting the remaining 6.2K points to qualify for PC. Will probably just buy some more wine...

astrosly

Active Member

- Joined

- Mar 4, 2013

- Posts

- 841

I have had no response to my complaint almost two months later, and they stated on numerous occasions that notification of the changes are provided on your credit card statement but I've looked on my last 6 Ultimate statements and there is nothing mentioned about this particular change.Very late reply to this post, but today is 25th August, and I have still had no communication from CBA for my existing Ultimate that I have had for about four years I think telling me that the spend to avoid the $35 per month fee is increasing.

I guess they have up until 11:59pm tonight to notify me of the changes, but it's looking like - at least for the moment, that I'm still on the $2,500 per month figure for avoiding the $35 per month fee.

Let us know if it is waived for you as CBA said the changes are applicable to existing card holders unless you have a wealth package.

Thanks.they stated on numerous occasions that notification of the changes are provided on your credit card statement but I've looked on my last 6 Ultimate statements and there is nothing mentioned about this particular change.

Let us know if it is waived for you as CBA said the changes are applicable to existing card holders unless you have a wealth package.

I don't have a wealth package.

I definitely have not received notification - via email, mail, or on a statement.

I am unlikely to drop below the new threshold now as I could no longer justify the fees on the Amex, so this is my main card.

However, I will probably drop below it at some point, and look forward to the conversation with them at that point in time.

I guess I had better check back through any revised T&C notifications just in case they slipped fees in there, but I don't think that they did as I write this reply.

Lewdannie

Junior Member

- Joined

- Dec 9, 2012

- Posts

- 48

I was declined an 15k limit Ultimate Rewards Card with the 70K points today because I had one pay slip showing a $1000 less due to unpaid sick leave. No matter that I have a permanent Government position that earns over $130 k (fixed) a year.

I am gobsmacked!

I am gobsmacked!

Last edited:

It certainly is the toughest assessment I've faced in terms of credit cards credit limits.I was declined an 15k limit Ultimate Rewards Card...that earns over $130 a year

I am gobsmacked!

I'm assuming you earn $130k a year, rather than $130 a year

When I first applied (about four years ago, give or take), at the time I had no problems being offered $30,000 for other cards, Amex Platinum charge was no limit, their tool would happily say it would approve a $120,000 car, but not a $150,000 car on the charge card, I was earning a base salary of $260k, and was offered $6,800 credit limit. I've taken four years to build it up to $24,800.

- Joined

- Dec 18, 2020

- Posts

- 326

- Virgin

- Platinum

- Oneworld

- Sapphire

- Star Alliance

- Gold

My salary is about 2.5 times that and I was declined a card with an $8.5k limitI was declined an 15k limit Ultimate Rewards Card with the 70K points today because I had one pay slip showing a $1000 less due to unpaid sick leave. No matter that I have a permanent Government position that earns over $130 k (fixed) a year.

I am gobsmacked!

We have a tiny mortgage by Sydney standards; my issue I suspect is that my HSBC Star Alliance card has a $50k limit

It’s like swimming in treacle trying to discuss ‘nuance’ with this lot. I offered to reduce the limit on my HSBC card but they wouldn’t tell me how much was needed to guarantee success.

The CSA re-submitted my application with ‘revised’ expenses. The credit card mob keep asking for more info’ and every time I upload it the application seems to be put to the back of the queue. Time consuming & frustrating. My patience is wearing thin.

Ironically I had the card with a $17k limit but closed the account in March. That may also be a black mark against me

With the devaluation of SQ via Amex I decided that a new non-aligned card was in order and this seems best …. out of a bad bunch

Post automatically merged:

Did you request credit limit increases or did CBA offer?It certainly is the toughest assessment I've faced in terms of credit cards credit limits.

I'm assuming you earn $130k a year, rather than $130 a year

When I first applied (about four years ago, give or take), at the time I had no problems being offered $30,000 for other cards, Amex Platinum charge was no limit, their tool would happily say it would approve a $120,000 car, but not a $150,000 car on the charge card, I was earning a base salary of $260k, and was offered $6,800 credit limit. I've taken four years to build it up to $24,800.

Enhance your AFF viewing experience!!

From just $6 we'll remove all advertisements so that you can enjoy a cleaner and uninterupted viewing experience.And you'll be supporting us so that we can continue to provide this valuable resource :) Sample AFF with no advertisements? More..

Sample AFF with no advertisements? More..

Sample AFF with no advertisements? More..

Sample AFF with no advertisements? More..