Shinjetter

Intern

- Joined

- Jan 21, 2022

- Posts

- 55

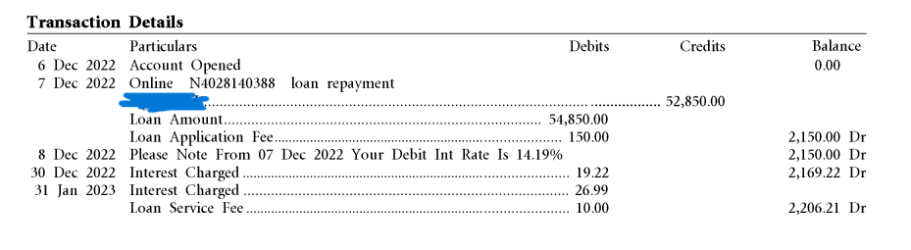

Hey everyone, I just received my 110,000 QF points. Back in Dec 2022, I signed up for this product and borrowed $55,000. When I signed up, I just said the purpose of the loan is for travel expenses. After 2 to 3 weeks, NAB sent me a link to input my SUB code reference number on Qantas. It said to wait 8 weeks for points to arrive. I just received it today. In term of 55k, I just repaid 53k in the account after they gave me 55k. I left 2k in there to keep the account open. Note: I applied for Citi Personal Loan Plus prior to this and received bonus points for that also. Here is the link. If you need qantas one, you can go to qantas.com/nab

www.nab.com.au

www.nab.com.au

Earn Qantas Points on a NAB Personal Loan

Learn how you can earn between 10,000 and 110,000 Qantas Points on a new online NAB Personal Loan.