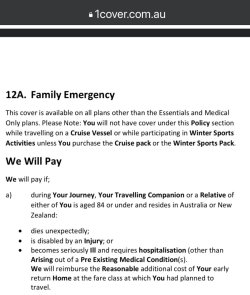

Need some advice on a business class ticket P from Bangkok to Madrid on Swiss/ Lufthansa And hoping someone on the forum can assist. We are booked next week. My mum (101 years) who lives with us, fell and broke her arm 2 weeks ago, is in hospital, and we have to cancel trip. Numerous calls and emails to Swiss call centre (based in Fiji) and on-line technical support have told us the only option is to rebook on the highest biz level which is almost double the original fare. Because of longer term implications of mum’s fall, we find it difficult to assess when to travel and would prefer a credit. We have a certificate from the hospital with particulars including all our names. I have cancelled all other bookings , SIA,Iberia, accommodations with straightforward fees and little hassle. Unbelievably, for me, is the amount of stress involved with Swiss. We have travel insurance but because of her age being over 80 years ( by some) they will probably not accept the claim.

any ideas would be greatly appreciated.

any ideas would be greatly appreciated.