offshore171

Established Member

- Joined

- Oct 8, 2014

- Posts

- 1,203

Hi all,

Looking for ideas or suggestions on this situation:

The 15 year old is doing a student exchange for a couple of months in England.

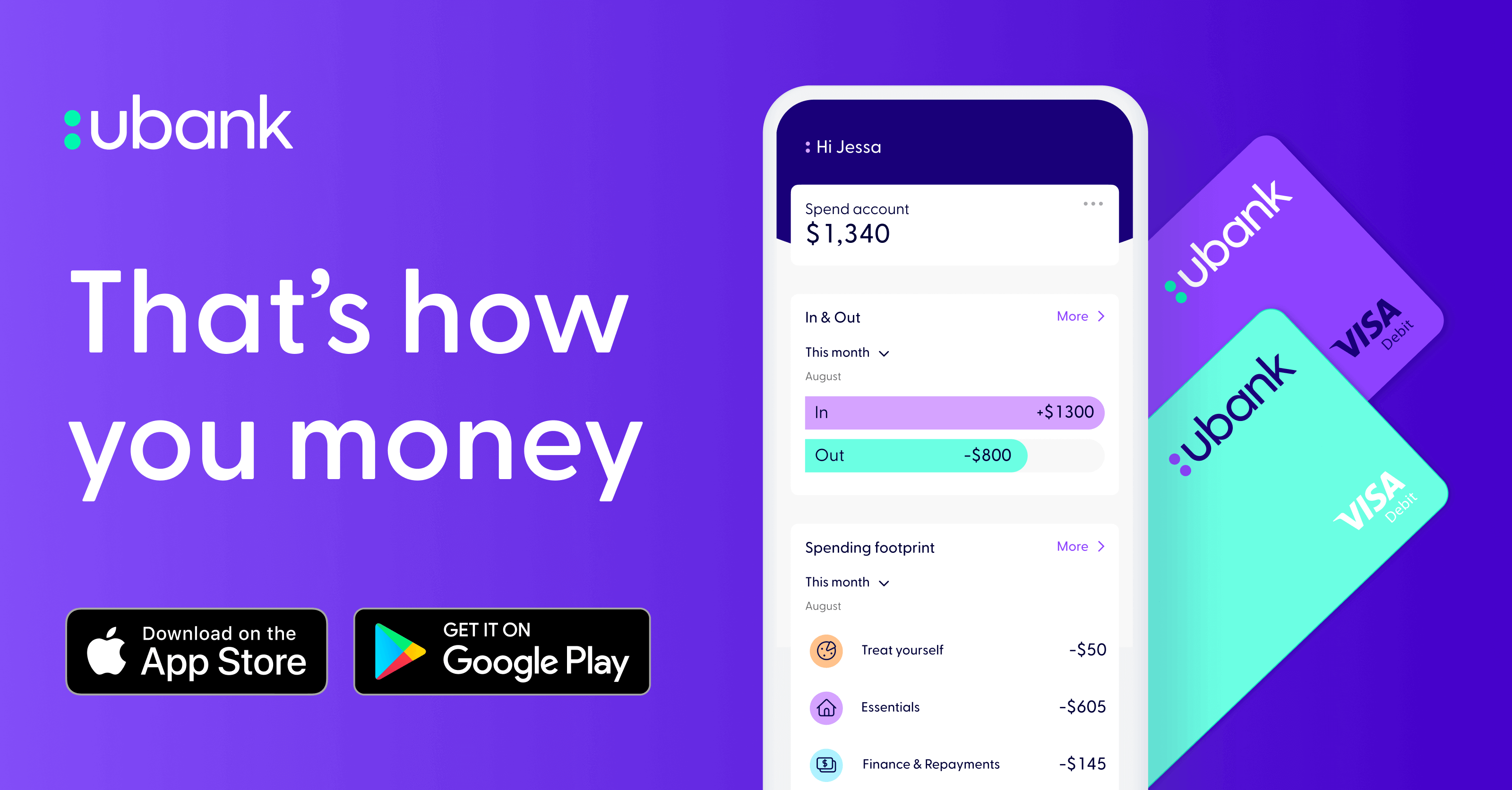

Food and board is covered, but there will be a need for some form of travel card I think, for incidentals or emergency use. I was thinking something I could load up with maybe £500 or so for emergency situations, with the option for me to top it up from Australia

I imagine this type of thing isn't that uncommon. How have others done it? Any recommended products?

Looking for ideas or suggestions on this situation:

The 15 year old is doing a student exchange for a couple of months in England.

Food and board is covered, but there will be a need for some form of travel card I think, for incidentals or emergency use. I was thinking something I could load up with maybe £500 or so for emergency situations, with the option for me to top it up from Australia

I imagine this type of thing isn't that uncommon. How have others done it? Any recommended products?