Given the risks involved with international travel, getting travel insurance in this post-COVID era is more important than ever. Some countries such as Singapore and Thailand are even requiring travel insurance with cover for COVID-19 as a condition of entry.

Unfortunately, despite Australia reopening its international border and downgrading its travel advisories for most other countries, there are currently very few travel insurers offering new policies that will cover overseas travel. Of the international travel insurance options that are available now, some also exclude cover for anything relating to COVID-19 or pandemics.

But the good news is that there are several COVID-19 travel insurance options for Australians that will cover international travel from November 2021, and the number continues to grow!

Please note that the information in this guide was correct (to the best of our knowledge) at the time of publication but is subject to change.

Contents

What COVID-related risks are covered by travel insurance?

No international travel insurance policy will cover every possible risk related to COVID-19. In fact, one of the biggest risks – widespread government lockdowns and border closures – is not covered at all. But most policies will at least pay for your quarantine, cancellation and/or medical expenses if you are personally diagnosed with COVID-19 and your trip is disrupted.

In general, most international travel insurance policies with coronavirus benefits will cover the following:

- The cost of medical treatment if you get COVID-19

- Additional accommodation costs if you are forced to quarantine due to testing positive for COVID-19

- Cancellation costs if you or your travel companion contracts COVID-19 in Australia and can’t travel

The following things are not covered by most travel insurance policies:

- Government-imposed border closures, lockdowns & travel bans

- Travel to countries classified by the Australian government as “Level 4 – Do Not Travel”

- Quarantine that you already knew would be required

- The cost of COVID-19 tests required for travel

- If you are not vaccinated or ignore public health advice such as hygiene & social distancing guidelines

- If you decide not to travel due to concerns about COVID-19

Which companies offer international COVID-19 travel insurance to Australians?

The following Australian travel insurance providers are currently offering international cover for COVID-19:

- Go Insurance (underwritten by Lloyds)

- Southern Cross Travel Insurance TravelCare policies

- Cover-More

- Allianz (plus some policies underwritten by Allianz on behalf of other insurers like Worldcare)

- Medibank & its subsidiary ahm (underwritten by Zurich Australian Insurance Limited)

- Qantas Travel Insurance (underwritten by Pacific International Insurance)

- InsureandGo (underwritten by Mitsui Sumitomo Insurance)

- RACV, RACQ, RAC and RAA Travel Insurance (underwritten by Tokio Marine & Nichido Fire Insurance Co., Ltd)

Other travel insurance options

Fast Cover offers an optional COVID-19 Pack including coverage for some COVID-related events. But this pack is only available for travel within Australia & New Zealand, with all other cover excluding COVID-19.

There are also a few international travel insurance companies that will provide COVID-19 cover to Australian residents. A popular option is Spanish insurer Heymondo (underwritten by AXA), which offers competitive pricing. However, as this is not an Australian company, it’s not clear how easy it would be to make a claim. You may wish to check online reviews before purchasing a policy.

Overview of COVID-19 coverage by insurer

Here is a summary of the COVID-19 cover offered by six of the main Australian travel insurance providers currently offering international COVID-19 travel insurance:

| Coverage |

Cover-More |

Go Insurance | Southern Cross | Allianz | Medi-bank |

Qantas |

| Travel to Level 2 countries |

✔ |

✔ | ✔ | ✔ | ✔ |

✔ |

| Travel to Level 3 countries |

✔ |

✘ (unless warning relates to COVID-19 only) |

✘ | ✘ | ✔ |

✔ |

| Travel to Level 4 countries |

✘ |

✘ (unless warning relates to COVID-19 only) |

✘ | ✘ | ✘ |

✘ |

| Trip cancellation costs if you or a travel companion is diagnosed with COVID-19 |

✔ |

✔ | ✔ | ✔ | ✔ |

✔ |

| Overseas medical expenses if you are diagnosed with COVID-19 |

✔ |

✔ | ✔ | ✔ | ✔ |

✔ |

| Additional accommodation costs if you are diagnosed with COVID-19 and required to quarantine |

✔ |

✔ | ✔ | ✔ | ✔ |

✔ |

| Medical evacuation or repatriation costs if you are diagnosed with COVID-19 |

✔ |

✔ | ✘ | ✔ | NZ only |

✔ |

| Additional accommodation if you are denied boarding of public transport due to COVID-like symptoms |

✘ |

✔ | ✘ | ✘ | ✘ |

✔ |

| Trip cancellation costs if your non-travelling relative or business partner in Australia or NZ is diagnosed with COVID-19 and their condition is life-threatening |

✔ |

✔ | Imme-diate family only | ✘ | ✔ |

In AU only |

| Trip cancellation costs if you are required to quarantine in Australia as a close contact of a confirmed COVID-19 case |

✔ |

✔ | ✘ | ✘ | ✔ |

✔ |

| Trip cancellation costs if you are a health care worker and your leave is revoked |

✔ |

✘ | ✘ | ✘ | ✔ |

✔ |

| Government-imposed border closures & lockdowns |

✘ |

✘ | ✘ | ✘ | ✘ |

✘ |

| Cancelling a trip because you are concerned about COVID-19 |

✘ |

✘ | ✘ | ✘ | ✘ |

✘ |

| Cover if you contract COVID-19 on a cruise |

✘ |

✔ (with cruise add-on) |

✘ | ✔ (with Cruise Pack) |

✘ |

✘ |

| Link to Product Disclosure Statement (PDS) for more information | Go Insurance PDS | Southern Cross SPDS | Allianz PDS | Medi-bank PDS |

Cover-More, Medibank and AHM also offer some protection against some additional scenarios relating to COVID-19 that other insurers do not, but only when travelling within Australia and New Zealand. This includes provisions for things like:

- The person you were due to stay with has COVID-19

- Your pre-paid accommodation or holiday activity is shut down due to a COVID-19 outbreak on the premises

- Travel delays or missed connections due to COVID-related cancellations, delays or re-routing

Allianz Travel Insurance policies have a general exclusion that anything relating to epidemics or pandemics is not covered. But Allianz will provide overseas emergency assistance and cover for overseas medical expenses if you are personally diagnosed with COVID-19 during your trip. If you or your travel companion is diagnosed with COVID-19, Allianz will also cover trip cancellation costs.

In addition, Allianz allows you to cancel your policy for a refund of the premium if you cannot travel due to a COVID-related border closure or would be required to quarantine, even if the regular cooling-off period has expired.

Allianz and Go Insurance may also offer some COVID-related cover for cruise holidays if you purchase a cruise add-on and are personally diagnosed with COVID-19 during your trip, although some exclusions apply.

Qantas Travel Insurance warns that it will not cover you if you fail to follow advice from official bodies or “knowingly put yourself into a risky situation”. According to the FAQs on the Qantas Travel Insurance website, “Just because you’ve got a face mask, doesn’t mean you should be travelling into a coronavirus hotspot.”

The impact of DFAT travel advice on insurance

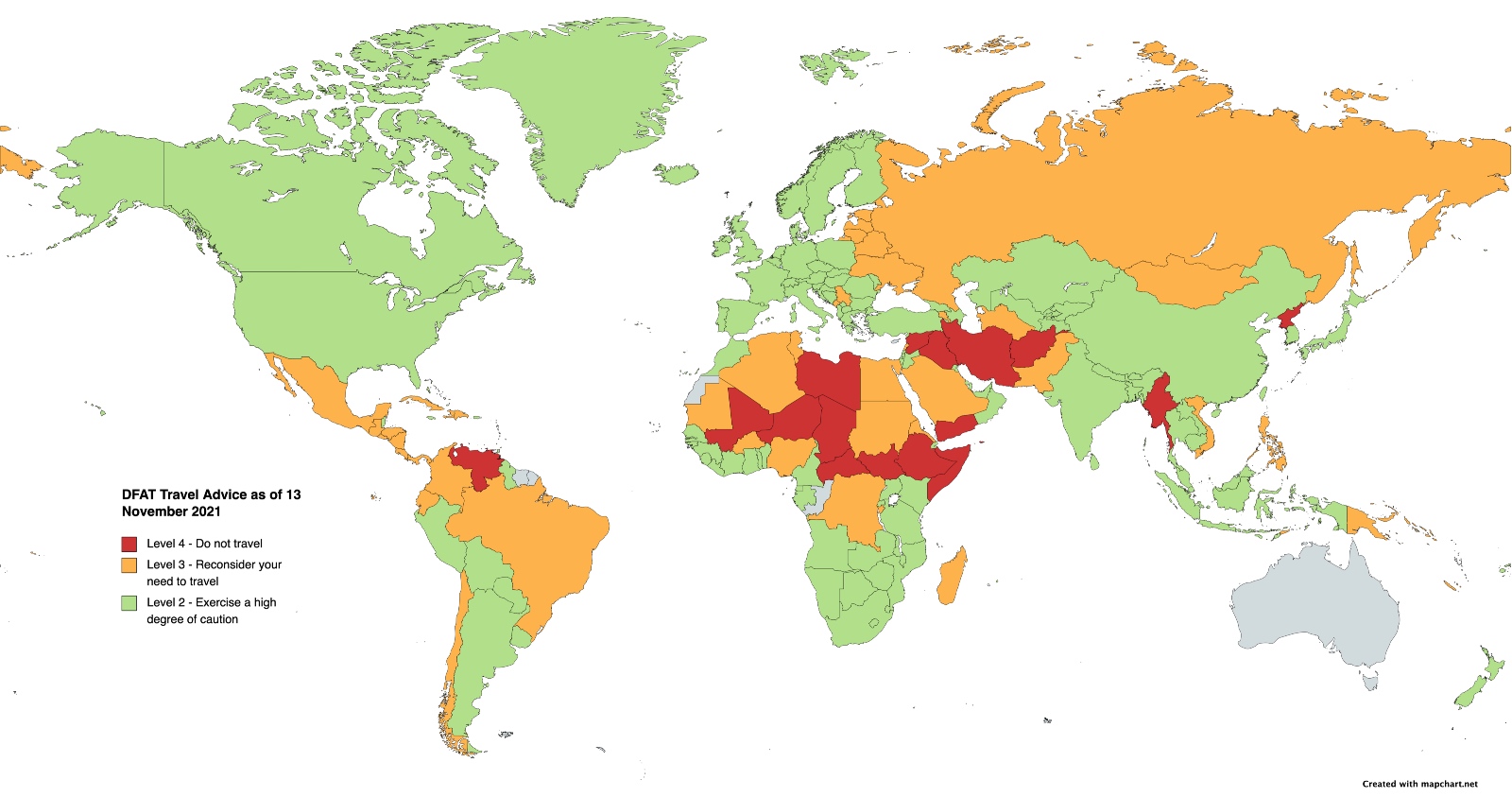

Some insurance will not cover travel to countries where the Australian Department of Foreign Affairs & Trade (DFAT) is warning Australians to “Reconsider your need to travel” (Level 3) and most don’t cover travel to places with a “Do not travel” warning (Level 4).

From March 2020 until October 2021, the Australian government had classified all other countries except New Zealand as “Do not travel”. This voided most Australian travel insurance. But on 28 October 2021, DFAT downgraded its travel warnings for 162 of the 177 countries for which advisories are issued.

Since then, DFAT has reclassified Ethiopia from Level 3 to a Level 4 destination meaning there are now 161 countries with a Level 2 or 3 warning. Of those, the travel advice for 112 countries is “Exercise a high degree of caution” (Level 2).

Most international travel insurance covers visits to Level 2 countries. This includes places like the UK, USA, Canada, France, Germany, Greece, South Africa, India, Argentina, Thailand and Singapore. Allianz and Southern Cross Travel Insurance do not cover travel to Level 3 destinations, but Cover-More, Medibank and Qantas Travel Insurance do.

Although Go Insurance does not generally cover travel to Level 3 or 4 countries, it says it will provide cover for travel to countries with these DFAT advisories if the only reason for the higher advisory level is the risk of COVID-19.

Note that DFAT travel advisories can change over time. This may affect your travel insurance coverage.

How much does COVID-19 travel insurance cost?

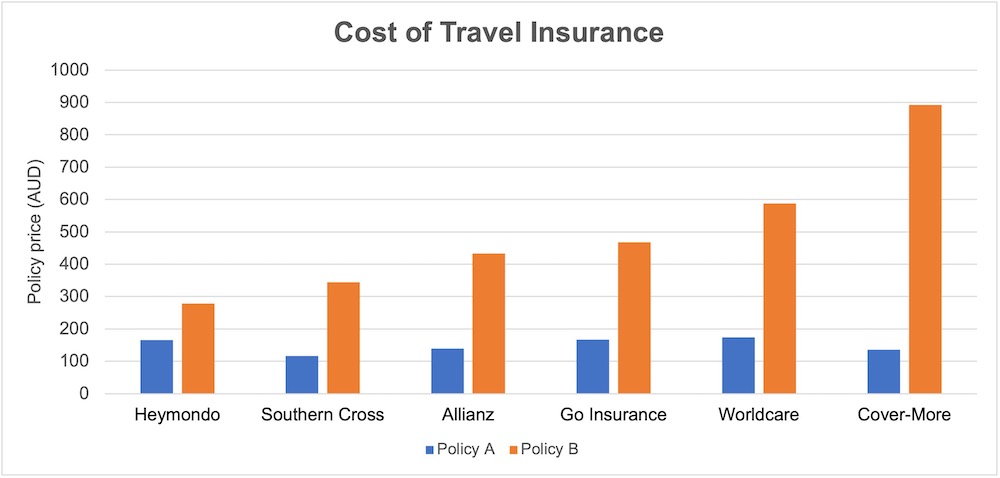

To give you an idea of approximate costs for international travel insurance offering coronavirus cover, we compared the premiums of six different companies for two different types of trips. In each case, we’ve selected the cheapest available single-trip policy with COVID-19 cover, with a $100 excess (where a choice was offered).

The quote for “Policy A” was for a hypothetical trip to the UK for a 50 year-old Australian travelling from 1-31 January 2022. The second sample quote, “Policy B”, was for a 30 year-old travelling to the USA & Canada from 1 February until 31 March 2022.

Here are the results:

For the month-long trip to the UK, Southern Cross Travel Insurance had the cheapest premium at $116. For the two-month trip to North America, Heymondo would provide the cheapest cover followed by Southern Cross. Bizarrely, Cover-More provided good value for Policy A but was the most expensive by a significant margin for Policy B.

For a week-long trip to Singapore, as another example, Cover-More quoted premiums between $62 and $102 (depending on the excess and level of cover).

It is important though to note that the inclusions with each policy are different. So, price is not the only factor you should consider when choosing travel insurance!

You should also read the PDS carefully before purchasing any travel insurance policy as each product may or may not be suitable for your needs! If you’re looking for information in the PDS about cover for COVID-19, you can jump straight to the relevant information by searching for terms like “COVID”, “Coronavirus”, “pandemic” and “epidemic” within the document.

Credit card travel insurance

Many premium credit cards come with complimentary travel insurance. Unfortunately, most credit card travel insurance automatically excludes cover for epidemics and pandemics.

American Express credit card insurance (underwritten by Chubb) does not specifically exclude cover for COVID-19 or pandemics. But this policy does exclude cover for “foreseen circumstances”, and Chubb declared COVID-19 a foreseen circumstance in early 2020.

One credit card travel insurance policy that may cover some international travel during COVID-19 is the ANZ premium card insurance (underwritten by Allianz), provided you are not travelling against government advice (i.e. to a Level 3 or 4 destination). Allianz has provided some information about travel insurance cover for ANZ cardholders in relation to COVID-19, but this doesn’t really make it clear one way or the other whether cover is provided.

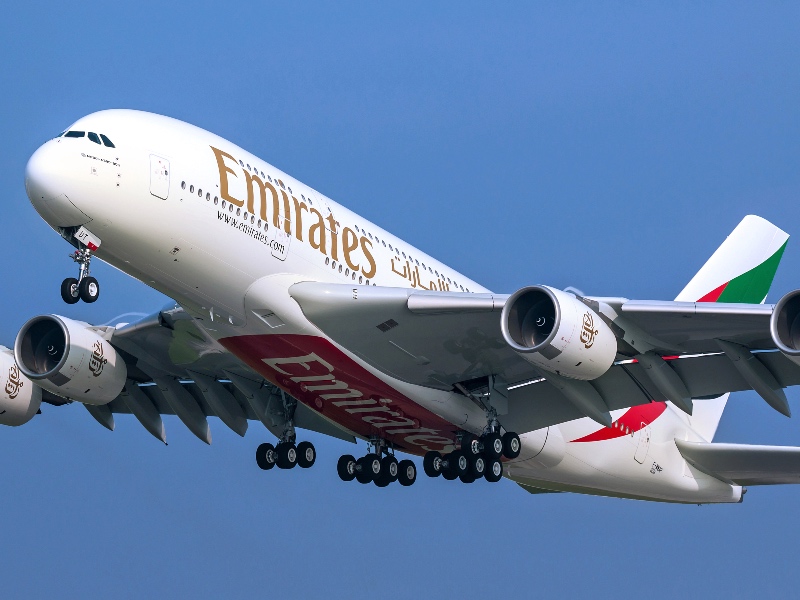

Free airline travel insurance

As an alternative to buying an individual travel insurance policy, a few airlines are still including COVID-19 travel insurance automatically in the price of their international airfares! These airlines include:

- Emirates (for tickets purchased by 30 November 2021 only)

- Cathay Pacific (for trips commenced by 31 December 2021 only)

- Japan Airlines (for flights departing until 31 March 2022 only)

- Etihad Airways (for trips completed by 31 March 2022 only)

The exact level of coverage varies by airline. In most cases, you would be insured in the event you get COVID-19 in transit or during your stay at your destination, if it’s a return ticket. If buying a one-way ticket, you would typically be covered for up to a month after arriving at your destination.

You can click on any of the links above to learn more about each airline’s COVID-19 insurance offer.

Australia’s reciprocal health care agreements

If you’re travelling to one of the 11 countries for which Australia has reciprocal health care agreements, you may also be able to access free health care at your destination under these arrangements. These countries are:

- Belgium

- Finland

- Italy

- Malta

- Netherlands

- New Zealand

- Norway

- Ireland

- Slovenia

- Sweden

- UK

The exact benefits available to Australians in each partner country vary. At a minimum, you can generally access emergency medical and hospital care in any of these 11 countries by simply showing your valid Australian Medicare card.

Even if you’re travelling to a country that has a reciprocal health care agreement with Australia, it’s still a very good idea to get travel insurance anyway. Reciprocal health care agreements will not cover any of your quarantine expenses or trip cancellation costs if you get COVID-19. Travel insurance will also cover you for many more of the things that could go wrong while overseas!

Join the discussion on the Australian Frequent Flyer forum: Travel insurance which covers COVID-19?

![Marriott Bonvoy Status Match [2020]](https://www.australianfrequentflyer.com.au/app/uploads/2020/08/marriott-bonvoy-phone-150x150.jpg)